Thinkorswim Trailing Stop - How to Set Up and Use

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

The Thinkorswim trading platform by TD Ameritrade is known for offering a lot of useful features to investors. One of those features involves being able to place trailing stop orders when making investments.

Many investors like using trailing stop orders because it allows them to ensure that their position doesn't end up with a loss after it has already established an unrealized profit.

This is a guide about Thinkorswim trailing stop orders. It will show how to set them up and how to use them.

What Is Thinkorswim?

Thinkorswim is a free trading software available from Schwab.

You can use it to buy stocks and options in the stock market.

TD Ameritrade customers can download Thinkorswim from here. It's available in different versions: desktop, web, and mobile.

Each version is unique and different from each other. This guide is going to show how to set up the desktop version of Thinkorswim.

Stock Market Guides

Stock Market Guides identifies stock trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

What Exactly Is a Thinkorswim Trailing Stop Order?

A trailing stop is a type of order used in stock trading. It is set up to ensure that the trader doesn't lose the profit they have gained on an open position. It is one of many order types available in Thinkorswim.

Typically, when you set up a trailing stop order, you indicate the amount that the stop order should be trailing behind the peak price of the stock while you own it. As the stock price reaches new highs, the trailing stop is following it and also moving up in price.

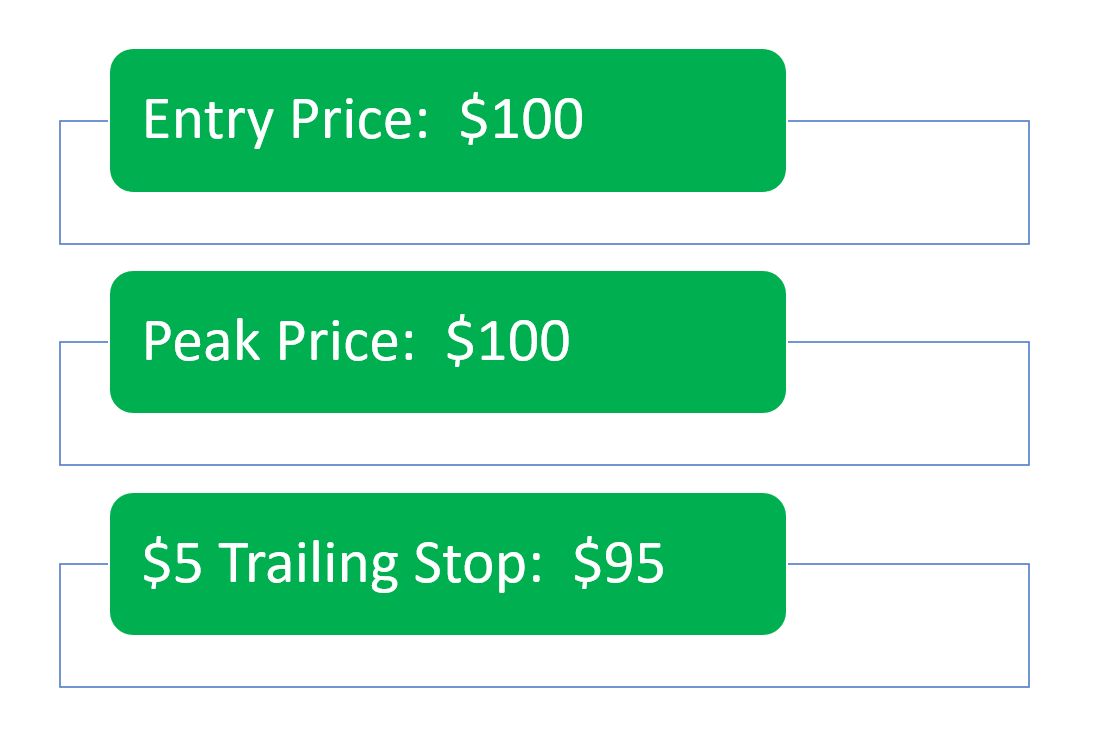

So for example, let's say you buy Apple stock for $100 per share. If you set up a $5 trailing stop, then the stock has to go down $5 from the peak value it reaches while you own it in order for the trailing stop order to be filled.

For this example, if the price of the stock goes straight down after you buy it, then the trailing stop order will be executed at $95 because the peak price the stock reached while you owned it was $100 (the initial price you paid).

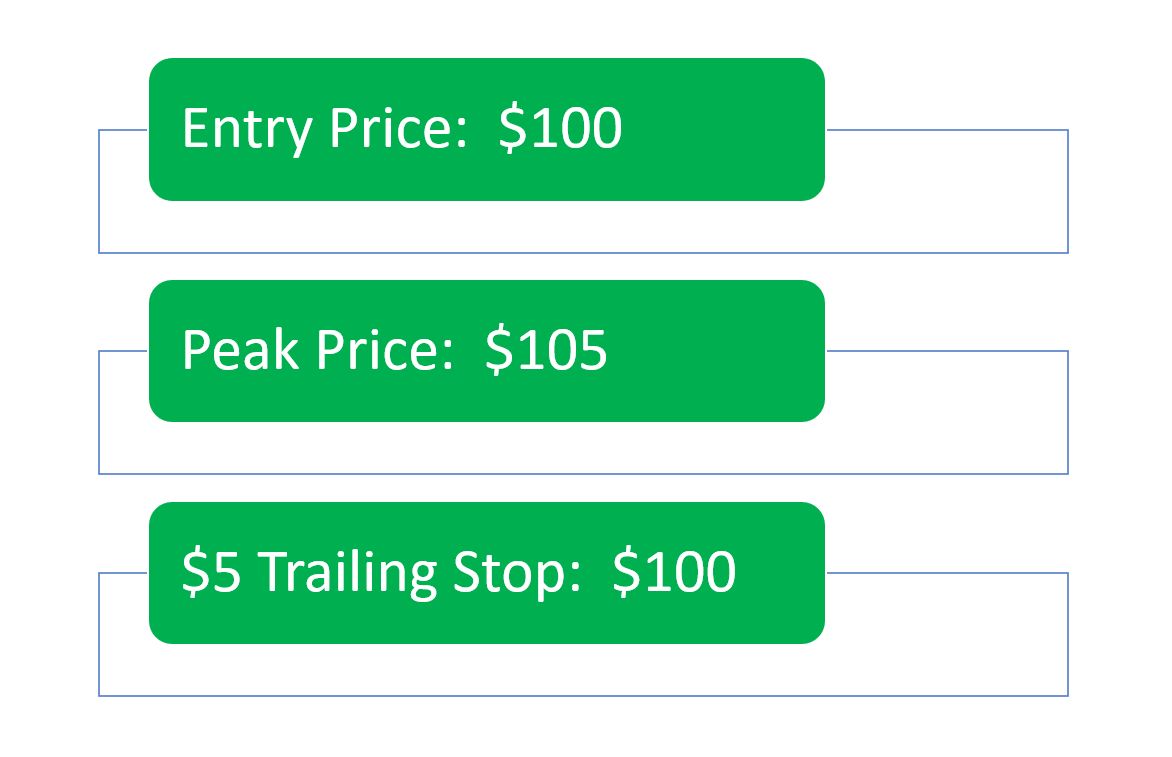

If, on the other hand, the stock price went up to a high of $105, at that point the trailing stop would be set at $100 ($5 below that new peak stock price).

If you buy a stock and it goes up in price by at least as much as the amount of your trailing stop while you own it, then you have a trade that is nearly risk free since the stop loss will be at or above the price you paid. It's not quite risk free due to gap risk and due to potential slippage associated with market stop orders.

How Do You Set Up a Thinkorswim Trailing Stop Order?

Here are the steps to set up a trailing stop in Thinkorswim:

-

In the Current Account section of Thinkorswim right-click the position you want to set the trailing stop for. You can also go to the stock chart and right click it.

-

Select "Sell" from the menu that comes up. This will bring up a window to set up an order to exit the position.

-

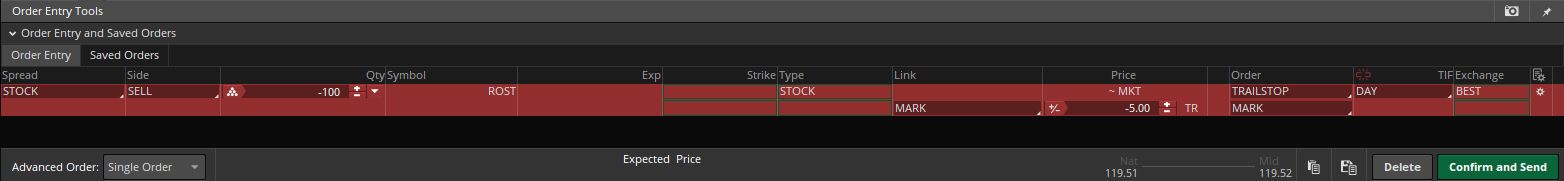

Ensure that the order details look correct, including the stock symbol and the number of shares you want to sell.

-

Change the order type from "Sell Limit Order" to "Trail Stop."

-

Specify the trailing stop distance by entering a negative dollar amount, as shown in the image above. If you enter "-5", it sets up a $5.00 trailing stop like the one described in the example above.

-

Choose the reference point for the trailing stop. This is the basis that will be used to establish the peak value. You can use the "Mark," which is the midpoint between the bid and ask prices when it comes to stocks. The mark is often considered a fair current value for the stock. You can also make the reference point be the last price, which some people like to do since it is verifiable on the stock chart.

-

Confirm the order, and if everything looks good, submit it.

Once you've completed these steps, the trailing stop will be in place, and it will adjust as the stock's price fluctuates, maintaining the specified distance below the current price.

This video about Thinkorswim trailing stop orders shows how to do each of those steps:

The Thinkorswim layout we used in that video was a custom one we created here at Stock Market Guides. It's available for free and you can learn how to use it in this guide about setting up Thinkorswim.

Learning More About Thinkorswim Trailing Stop Orders

You can contact us any time if you would like to ask any questions about Thinkorswim trailing stop orders or anything about trading in general.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.