Options Trading for Beginners

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Options trading is like stock trading but on steroids. Options amplify profits and losses due to the leverage they offer.

For beginners, options trading can be exciting due to the income prospects they offer. It can also be overwhelming due to the seeming complexity.

This guide will help beginners by explaining in plain English what options are and how to buy options.

Our guide won't be like reading a definition out of the dictionary. It will be like listening to a friend who is an expert at options trading and can break it down into terms you can easily understand.

We'll use screenshots to ensure you have a visual with our written explanation. By the end, we think most beginners will better grasp how options trading works.

What Are Options?

Options, also sometimes referred to as stock options, offer people a way to invest in a stock at a much lower price than buying the stock itself. Options are linked to stocks but have different characteristics than stocks.

Here are the critical aspects of any given option:

Options Have an Expiration Date

Any time you buy an option, it has an expiration date. Options are different from stocks in that way. You can own a stock forever, but you can only hold an option until its expiration date.

You Can Convert Options Into Stock

One characteristic of options is that they allow you to buy the stock to which they're connected (also known as the underlying stock).

The conversion of an option into stock typically takes place when the option expires.

If you own an option at the expiration date and the option has value, you can realize the value of the option position by converting it into stock. The following section talks about why.

Only some people hold options up until their expirations. Traders can buy and sell options before expiration, just like someone would buy and sell stocks.

Options Have a Strike Price

Here is a video that explains what strike prices are:

For every option, there is a strike price. It's the price you'll be able to buy or sell the stock for at the expiration date.

So if you own a call option with a strike price of $80, it means you have the right to buy the stock for $80. It would only make sense to exercise the option is the strike price were lower than the stock price, which is an indication that it has intrinsic value.

Again, many options traders never let options expire and buy and sell options before expiration. But the strike price is still a core component of the valuation of an option at any given time.

Call Options and Put Options

Ok, time to define the funny words. All options are either a call option or a put option.

As to who chose the terms "call" and "put" or why they chose them, we have no idea. They're not intuitive to most people.

So they're just terms you'll have to memorize if you want to trade options regularly.

Call options are options that give you the option to buy the underlying stock. They typically go up in value when the stock price goes up.

Put options allow you to sell the underlying stock. They typically go up in value when the stock price goes down.

So if you expect the stock price to go up, you could buy call options to try to benefit from that. If you expect the stock price to go down, you could buy put options to try to benefit from that.

This video explains more about call options versus put options:

Not All Stocks Have Options Available

Many of the biggest companies, such as Apple, have stock options available to trade. But not all companies have options available.

Stock Market Guides

Stock Market Guides identifies option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

150.4%

Example of What an Option Looks Like

Here is an example of what an option might look like:

AAPL December 14 100 Strike Call

Let's break down the pieces here:

• AAPL – This refers to the underlying stock associated with the option. In this case, it's for Apple stock.

• December 14 – This refers to the expiration date of the option.

• 100 Strike – This refers to the strike price of the option.

• Call – This indicates that this is a call option, not a put option.

How to Buy Options

Ok, now that you have a grasp on what options are and what they look like, the next part of our guide will help you learn how to buy options.

Get a Brokerage Account For Options Trading

If you want to buy options, you need the correct type of account to do so. You need a brokerage account that caters explicitly to options trading.

To many people, the term "brokerage account" is unfamiliar. It's simply an account that lets you make transactions in the stock market.

It's similar to a bank account in that you can keep your money in the account, but it's different because bank accounts don't let you buy stocks and options.

Since brokerages allow you to make trades in the stock market, almost all of them have an online trading platform. It is where you can go to buy and sell stocks or options.

We have a guide for the best trading platforms. We like the Tradier platform for making options trades. Their platform is one of the simplest we've found, and it's also free to set up.

Signing up for an account with an options trading broker is not always painless. They typically ask a lot of questions. But once you finish that, then you can jump into options trading.

Pro tip: they will ask you what level of options trading privileges you want. Most people who want to buy and sell simple options choose Level 2 (also referred to as Tier 2). You have to decide what you want, but that's the level required to make simple options trades.

Put Money In Your Trading Account

Now that you have a brokerage account, it's time to deposit some money in it. You can only buy options if you have money in the account.

Most brokerages will guide you through connecting your bank account with your brokerage account. That allows you to slide some money over to begin your options trading.

Use Your Trading Account to Buy Options

Your money is in the account, and you're ready to buy and sell options. If you'd like to see a video that demonstrates how to buy options, you can watch this one:

We will use screenshots from Tradier to show precisely how to buy options.

First, you must pull up a ticker symbol for the underlying stock. In Tradier's platform (which they call Dash), that is done through the Dashboard page as shown here:

Then type in the ticker symbol of that stock. For Apple, the ticker symbol is AAPL. To find the ticker symbol for any company, you can do a Google search for "Apple ticker symbol." Just replace 'Apple' with any company you want.

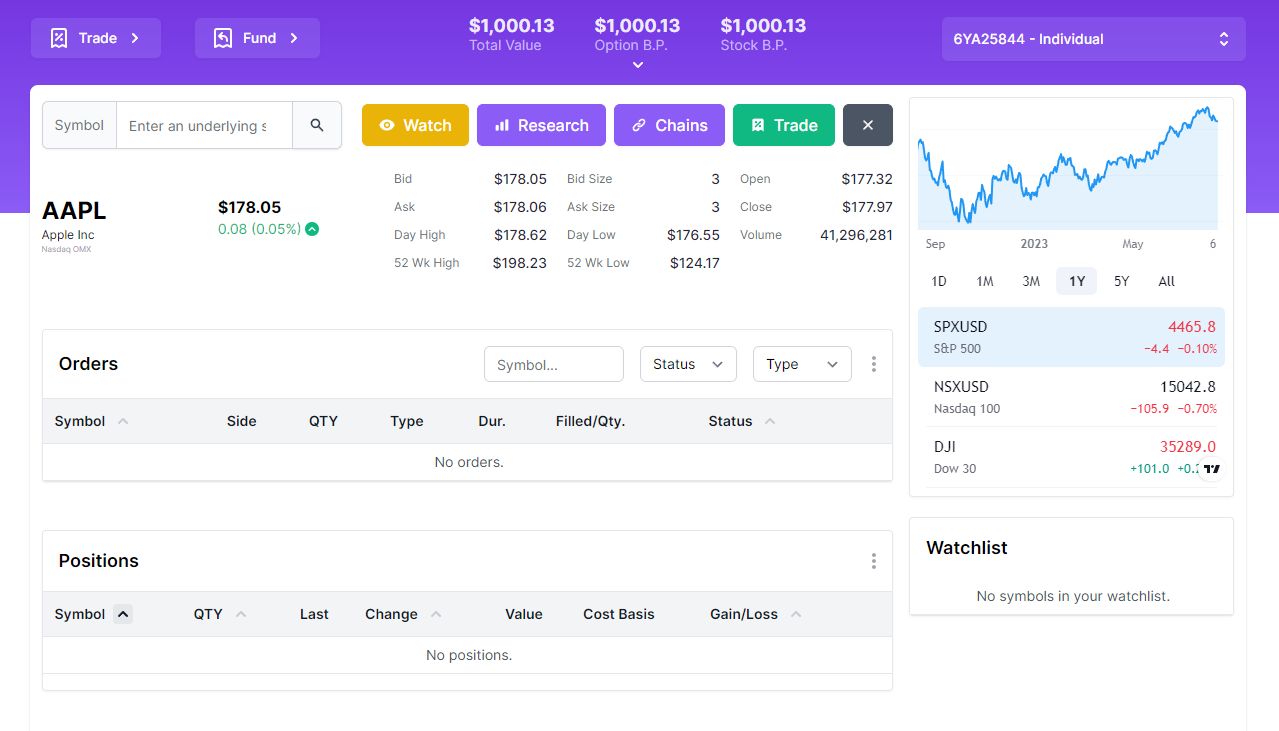

In Tradier, after you type in AAPL, it brings up a page that looks like this:

As you can see, it shows all the core information about AAPL stock there, including the current price.

From here, to buy an option, you need to click the purple button at the top that says "Chains." That's referring to the options chain.

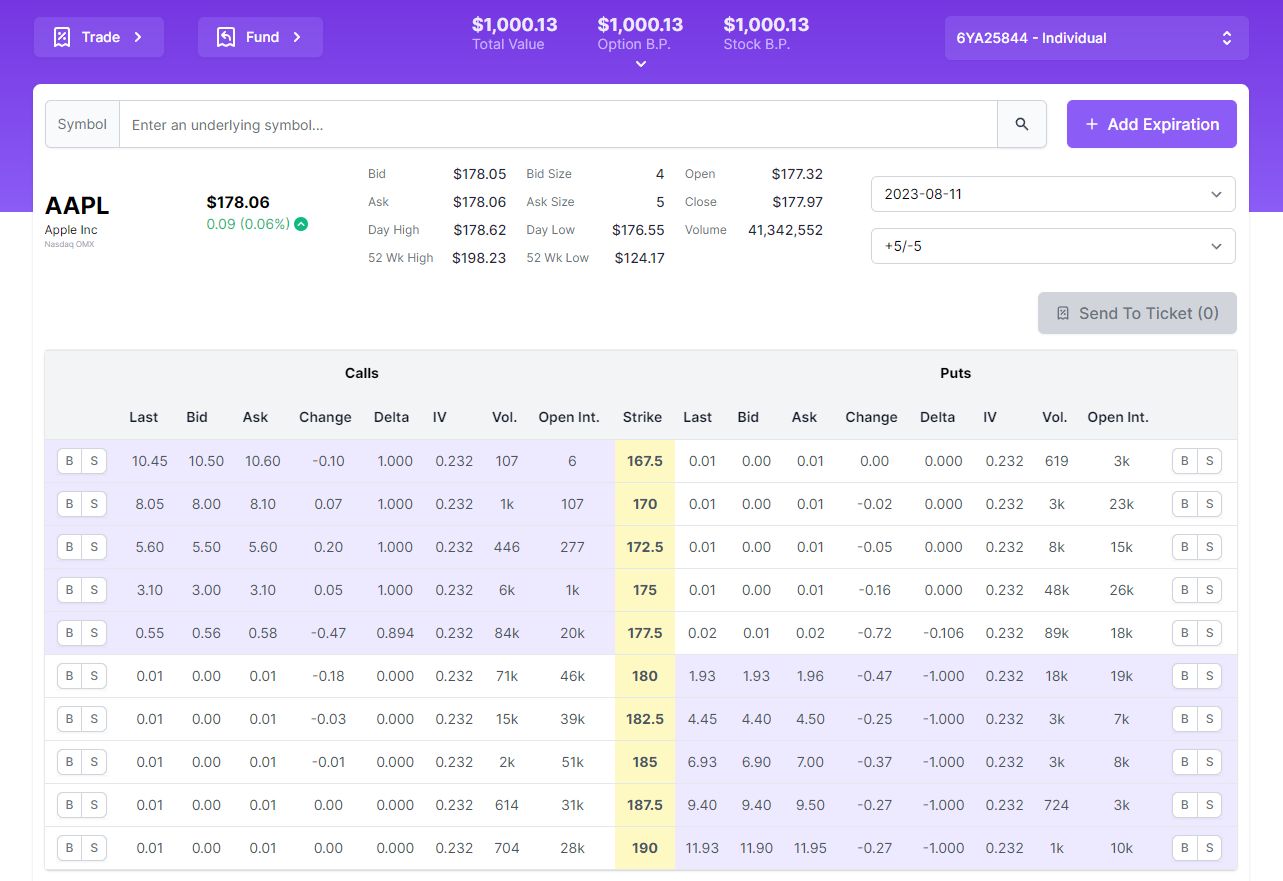

It's a list of all the options available for that particular stock. Here's what it looks like on the Tradier platform:

You can see call options on the left side, and on the right side, you can see put options. The middle column indicates the strike prices. And there is a filter at the top to control the expiration date.

At the far left side of the options chain in Tradier is a column with icons showing the letters B and S. The B stands for buy, and the S stands for Sell. The far left column is for buying and selling call options, and the far right column is for buying and selling put options.

To offer a tutorial for this article, we went through the steps of buying a call option for AAPL. We want to purchase the August 11 expiration call option with a 175 strike price.

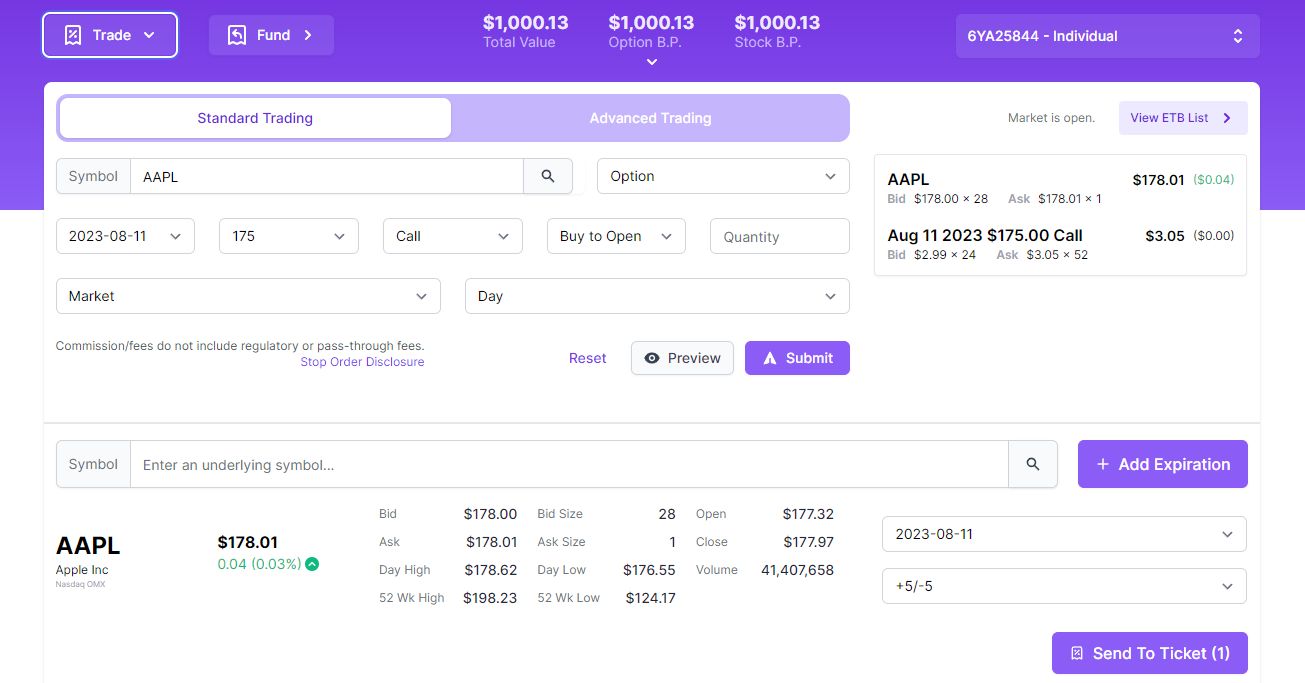

We clicked the B at the far left of that row in the options chain, and it brought up this page:

That page is where you can enter the details for your options trade. The page auto-populates most of the fields based on what we selected from the options chain:

• AAPL (in the Symbol field)

• Option (as opposed to stock)

• August 11 (the expiration date of the option)

• 175 (the strike price)

• Call (as opposed to Put)

• Buy to Open (the "Open" term means you are entering a new position)

The remaining fields need some explanation:

Quantity

There is an empty Quantity field. That's where you enter the number of contracts you want to buy.

Keep in mind that one option contract represents 100 shares of stock. That means when you see an option price, you will have to pay 100 times that amount of cash to buy the option.

So in our example, the Apple option we wanted was $3.10. That means we would need to use $310 to purchase the option.

Order Type

The two usual choices here are either Market or Limit.

To explain those, first, we need to talk about the mechanics of prices in the stock market. For any given asset, there are buyers and sellers.

When someone wants to buy a stock, the price they are willing to pay is a bid. When someone wants to sell, it's an offer (or ask).

A transaction occurs when the bid criterion for a buyer matches the ask criterion for a seller.

At any given time, you can see the highest bid and the lowest ask price for a stock or option. These are respectively referred to as "the bid" and "the ask."

You'll typically see some distance between the bid and the ask. If the bid and the ask were the same, that would have already resulted in a transaction. That means there is space between the bid and the ask for any remaining open orders.

If you look again at the screenshot above, you'll see the bid and the ask indicated there for the Apple option. It shows a bid of $3.00 and an ask of $3.10.

That means the highest bidder out there is willing to pay $3.00. And the lowest seller out there is willing to sell for $3.10.

Now let's look at the two order types: market and limit.

If you submit an order to buy an option using a market order, it will match you up with the nearest seller. You don't indicate a numeric price since "market" means you'll pay the market price. In this case, you would likely pay $3.10 for your option.

If you buy the option using a limit order, you indicate the exact price you are willing to pay. Your order will only get filled if you get that price or lower.

There are tradeoffs with each order type.

With a market order, you ensure you get into the position quickly, but you might make a sacrifice on the price since you're automatically paying the ask price.

With a limit order, you can try to get a lower price (for example, a price between the bid and ask), but you risk missing the trade opportunity if your order isn't filled. So limit orders offer less certainty of fulfillment than market orders do.

There is no perfect order type for every situation. Ultimately you have to decide for yourself which tradeoffs you prefer.

Time In Force

It is the last field on the Tradier order entry page. You have two choices here:

• Day – Your order will only be active until the current day's trading session ends.

• GTC – This stands for Good Til Canceled, which means your order will be active until you cancel it.

Once you've entered all your preferences, you can click the Submit button to submit your order.

If you use a market order, your broker will fill your order immediately. If you use a limit order, it may not be filled right away.

We set up a buy limit order for the Apple option.

In Tradier, you can see a blue status bar that says Open in the Orders section. You can click the Settings icon on the right side if you want to edit your order (for example, to change the price of your limit order).

Once the order gets filled, there will be a green Filled icon next to the order. There is a section that shows "Positions." You can click the box to the right and click the Close Positions button above it.

It's the same process to then sell the same option that you just bought.

After you successfully sell the option, there will be no positions showing in the Positions section. That confirms that you have successfully sold the options position and no longer have any open positions.

Choose Which Options to Buy

At this point, you've gotten through all the fundamentals of how to trade options.

You're making progress on eliminating your "beginner" status. And you're past the most tedious parts of learning options trading.

Now it's time to get into the fun part: choosing which options to buy.

It's the million-dollar question. If you find a way to trade options profitably, you could have a bright financial future.

We have some solid ideas to help beginners get headed in the right direction.

Learn Proven Options Trading Strategies

There are tons and tons of options trading strategies out there. It can be overwhelming to get your arms around everything.

We've done a lot of research here ourselves, and we put together a list of the best options trading strategies.

We used historical research and statistical analysis to create those strategies, so they aren't just pie-in-the-sky ideas. They should give you a solid resource for learning to trade options profitably.

You can also sign up for an options trading course. That might offer you a more personalized learning experience to get you up to speed on how to trade options profitably.

Sign Up With an Options Alert Service

If you want to try to make money from trading options without learning all the strategies, then you're like many other people.

It can take a lot of time to become effective at trading options. Many people either don't have the time or aren't interested in dedicating that much time to mastering the discipline.

Enter options trading alert services. These are services where stock market professionals do all the research for you and alert you when potential option trade opportunities arise. They pick the options, and you decide whether you want to follow along.

We've put together a list of the best options alert services. Our guide allows you to quickly compare them all side by side to decide who you like best.

Conclusion

Our goal with this guide was to make it easy to understand the basics of options trading so that any beginner could understand it.

We communicated the information as if we were sitting together at lunch, talking informally and trying to help you really get it.

If that worked and you're up to speed now, then it's time for you to begin your options trading adventure!

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.