How to Buy Stocks - For Beginners

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

For a lot of people, the stock market can seem daunting. They might know they should be investing, but they feel overwhelmed by the prospect of getting started with buying stocks.

This guide will help those beginners who have never bought stocks. As you'll see, getting started is not overly complicated.

Also, we'll show you ways to make money in the stock market that can be as simple as one click of the mouse. You can buy the stock the world's most famous investor recommends for everyone and let it ride on its own forever after if you want. It's like hitting the "Easy" button for a beginner.

What Are Stocks?

Let's first define what a stock is. We're going to use an example to help illustrate it.

Let's look at Apple, one of the biggest companies in the world. It's a public company.

That means that there are no individuals who privately own Apple. So it's not just some guy or gal who single-handedly owns the entire company.

Most small businesses are private companies, and there is a single owner. But for huge companies, many of them are public companies. And for them, the company is owned by the general public.

For companies like Apple, anyone can pay to own a piece of the company. A share of stock represents one share of ownership in a public company like Apple.

So if you buy a share of Apple stock, you are purchasing one share of an ownership stake in Apple.

Stock Market Guides

Stock Market Guides identifies stock trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Why Buy Stocks?

So continuing with our Apple example, what benefits do you get from owning a stake in the company?

Does it mean you get to control the business and make decisions for the company? No, it doesn't. You would only get that power if you owned more than half the shares of Apple stock, which would require billions of dollars at this point.

So what are the benefits of owning Apple stock, then? There are two key benefits:

Stock Price Growth

The prices of stocks fluctuate based on supply and demand.

If you're a beginner with stocks, you don't have to spend much time understanding their reasons. That makes it harder to get started with buying stocks.

The key is understanding that the prices of stocks go up and down. Also, you can buy and sell stocks easily in most cases.

If you buy Apple stock for $100 for one share, and later the prevailing price goes up to $200 for one share, you could sell the stock and collect a nice profit.

That is the primary benefit of buying stocks. As the prices go up, your wealth grows. And history shows that over the long haul, stock prices have gone up an average of 9.8% per year.

Stock Dividends

Some companies, like Apple, issue dividends. Not all companies do. A dividend is when a company disburses cash to its owners. For each share of stock you own, you will receive a dividend.

Typically the dividend for each share of stock is a relatively small amount. But it does represent another part of the financial benefit of buying stocks.

So imagine you buy a share of Apple stock, and you get a small dividend every three months. And in the meantime, the price of the stock itself is also growing. All these forces are why many people become wealthy from buying stocks.

How to Buy Stocks - Step by Step

Now that it's clear what stocks are and why people like to buy them, let's go step by step through purchasing a stock starting from square one. You can watch this video if you prefer a video tutorial of the process:

Set Up a Brokerage Account to Buy Stocks

The term "broker" or "brokerage account" can be confusing to understand at first for many people.

We're going to keep it simple and help explain it by using an analogy.

When you have money, there are different types of accounts where you can put your money.

If you want to put your money in an account where you can easily access it and write checks or withdraw cash from an ATM, then you typically set up a bank account.

If, on the other hand, you want to put your money in an account that allows you to buy stocks, then you need a brokerage account. It might seem like a foreign term if you're a beginner, but it's just the terminology used to describe an account that can buy and sell stocks. Most brokerage accounts have stock trading apps, and that might sound like more familiar terminology to most people.

There are many brokerage accounts out there that are free to set up. You can choose one from our list of the best stock trading platforms.

We like Tradier. They're a brokerage that makes it simple to buy stocks online. We'll feature Tradier in our tutorial later in this guide.

Setting up a brokerage account involves more than just a click or two. It may take some time to go through all the forms, but at least it's just a one-time deal to complete them.

Put Money in Your New Brokerage Account

After you set up the brokerage account, it's time to put money in it. You can't buy stocks if you don't have money in the account.

Most brokerages will clarify how to put money in the account right after you open it. Most times, it involves connecting your bank account with your brokerage account to transfer money between them electronically.

It's worth noting that typically when you make your first deposit into a new brokerage account, it takes about a week for them to let you use that money. So don't expect that you'll be able to instantly buy stocks after making the deposit.

Buy Stocks That You Want

You're ready to buy stocks now that your brokerage account has money. If you're wondering which stocks to buy, we have a section below that might simplify that decision.

But for now, we want to show you how to buy stocks in the first place. So we're going to retake the example of Apple and show you step-by-step how to buy Apple stock using screenshots from the Tradier brokerage account.

First, you must pull up a ticker symbol for the underlying stock. In Tradier's platform (which they call Dash), that is done through the Dashboard page as shown here:

Then type in the ticker symbol of that stock. For Apple, the ticker symbol is AAPL. To find the ticker symbol for any company, you can do a Google search for "Apple ticker symbol." Just replace 'Apple' with any company you want.

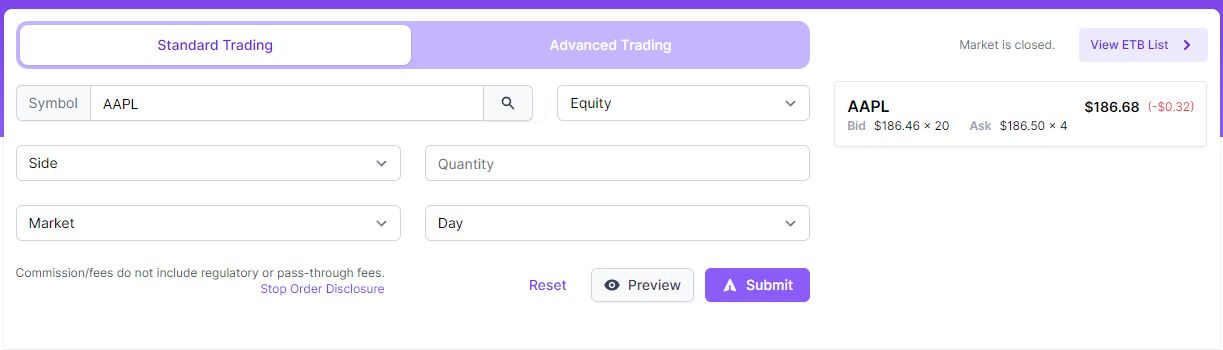

In Tradier, after you type in AAPL, it brings up a page that looks like this:

As you can see, it shows all the core information about AAPL stock there, including the current price.

From here, to buy shares of stock for Apple, you need to click the green button at the top that says "Trade."

Doing that takes you to a page that looks like this:

That is where you can enter the details for your stock trade. These fields are already auto-populated:

• AAPL (in the Symbol field)

• Equity (refers to stocks, as opposed to options or other assets)

• Buy (as opposed to Sell)

The remaining fields need some explanation:

Quantity

There is an empty Quantity field. That's where you enter the number of shares of stock you want to buy.

Order Type

The two usual choices here are either Market or Limit.

To explain those, we need to talk about the mechanics of prices in the stock market. For any given asset, there are buyers and sellers.

When someone wants to buy a stock, the price they are willing to pay is referred to as a bid. When someone wants to sell, it's an offer (or ask).

A transaction occurs when the bid criterion for a buyer matches the ask criterion for a seller.

You can see the highest bid and the lowest ask price for a stock at any given time. These are respectively referred to as "the bid" and "the ask."

You'll typically see some distance between the bid and the ask. If the bid and the ask were the same, that would have already resulted in a transaction. Any open orders will not have overlapping bid and ask prices.

If you look again at the screenshot above, you'll see the bid and the ask indicated there for the Apple stock. It shows a bid of $186.46 and an ask of $186.50.

That means the highest bidder out there is willing to pay $186.46. And the lowest seller out there is willing to sell for $186.50.

Now let's look at the two order types: market and limit.

Market Orders

If you submit an order to buy stocks using a market order, it will match you up with the nearest seller. You don't indicate a numeric price since "market" means you'll pay the market price for the stock. In this case, you would likely pay $186.50 for your shares.

Limit Orders

If you buy the stock using a limit order, you indicate the exact price you are willing to pay. Your order will only get filled if you get that price or lower.

There are tradeoffs with each order type.

With a market order, you ensure you get into the stock position quickly, but you might make a sacrifice on the price since you're automatically paying the ask price.

With a limit order, you can try to get a lower price (maybe a price between the bid and ask), but you risk missing the trade opportunity if your order isn't filled. So limit orders offer less certainty of fulfillment than market orders do.

There is no perfect order type for every stock purchase. Ultimately you have to decide for yourself which tradeoffs you prefer.

Time In Force

That is the last field on the Tradier order entry page. You have two choices here:

• Day – Your order will only be active until the current day's trading session ends.

• GTC – This stands for Good Til Canceled, which means your order will be active until you cancel it.

Once you've entered all your preferences, you can click the purple Submit button to submit your order.

The broker will fill your order immediately if you use a market order. If you use a limit order, it may not be filled right away.

Once you submit your order, most trading platforms will indicate whether the order is "Open" or "Filled". Once an order is filled, you typically can see the stock reflected in the Live Positions section of the platform.

Note: If you want to buy stocks premarket (before the market opens), you use a TIF setting of EXT, which stands for Extended Hours.

Choosing Which Stocks to Buy

The thing that freezes a lot of people in their tracks is trying to figure out which stocks to buy. There are an overwhelming number of possibilities, which can be daunting for a beginner.

We're here to help!

Remember that we're not financial advisors, so we can't advise you on what to do. We're going to educate you on some possibilities.

The other thing to remember is that there is real risk involved with buying stocks. There is no guarantee that the stock price will go up after you buy it. It can do the exact opposite.

The Easy Button

If your primary goal is to know that you invested your money intelligently and don't have to feel left out anymore, then you can follow Warren Buffett's advice.

Buffett is likely the most famous investor ever, and he thinks everyone who isn't a stock expert should buy and hold "the market" if they want to invest in stocks.

What he means by that is that instead of trying to pick one stock to buy, buy something that represents the entire market.

There are Exchange Traded Funds (ETFs) that serve this exact purpose. Buying a share of an ETF is like buying a sliver of each company in the stock market.

And the good news is that people can trade ETFs like stocks. So buying an ETF is like buying a stock.

The ticker symbol SPY represents the ETF for the S&P 500.

You don't need to worry if you're feeling acronym overload. You don't need to memorize any of these. The critical point here is that you can buy shares of the ticker symbol SPY, which is like buying a single stock representing most of the stock market companies.

So if you want to follow Warren Buffett's advice, you type the ticker "SPY" into your brokerage account and buy as many shares as you'd like.

From that point, you can set it and forget it. You could leave your account untouched until you retire, and the size of your account will grow and shrink with the market.

Considering the stock market's track record of growth, we can understand why Buffett thinks this is a good idea. No one can fault you for taking an investment approach like this, and many brilliant people do it (us included!).

Actively Buying Stocks

You can consider a more active investing approach if you want to do more than buy stock for a single ticker symbol.

There are different types of active investing, including swing trading and day trading. You can check out our guide on the differences between them.

You can do your own research to find stocks to buy. We offer a stock scanner that can accommodate that.

If you want help from stock market professionals, consider joining a stock picking service. They'll give you their ideas on the best stocks to buy and do all the research to come up with their picks.

You can also consider taking a stock trading course. It could help you improve your knowledge. They cost money, but that could be a very worthwhile investment. Some stock market courses include a trading chat room where you can converse with other members and share trade ideas.

If you don't want to rely on anyone else and want to learn to buy stocks on your own, then you can learn investing strategies. We used years of research and testing to develop our guide for stock trading strategies. Or alternatively, you could do your own research using our guide for the best websites to research stocks.

Conclusion

As you can see, learning how to buy a stock isn't as bad as it seems.

Understanding that a brokerage account is needed to buy and sell stocks is key. And once you put money in your brokerage account, you need to put in an order to buy any particular stock you want.

From there, it's just a matter of deciding how actively you want to be involved with buying stocks. If you want to keep it simple, there are ways to set it and forget it. Many resources are available to help you build on your stock-buying knowledge if you want to be active.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.