SunOpta Inc.

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

SunOpta Inc. Company Information, Fundamentals, and Technical Indicators

SunOpta Inc. engages in the manufacture and sale of plant and fruit-based food and beverage products in the United States, Canada, and internationally. It provides plant-based beverage products, including oat, almond, soy, coconut, rice, hemp, and other bases under the Dream and West Life brands names; oat-based creamers under the SOWN brand name; ready-to-drink protein shakes; packaged teas and concentrates; meat and vegetable broths and stocks; and nut, grain, seed, and legume-based beverages. The company also offers plant-based ingredients, such as oatbase, soybase, oatgold, hempbase, and soy powders and okara; ready-to-eat fruit snacks made from apple purée and juice concentrate in bar, bit, twist, strip and sandwich formats; cold pressed fruit bars; ready-to-eat fruit smoothie and chia bowls topped with frozen fruit; and liquid and dry ingredients for internal use and for sale to other food and beverage manufacturers. It sells its products through various distribution channels, including foodservice operators, grocery retailers and club stores, branded food companies, and food manufacturers, as well as e-commerce channels. The company was formerly known as Stake Technology Ltd. and changed its name to SunOpta Inc. in October 2003. SunOpta Inc. was incorporated in 1973 and is headquartered in Eden Prairie, Minnesota.

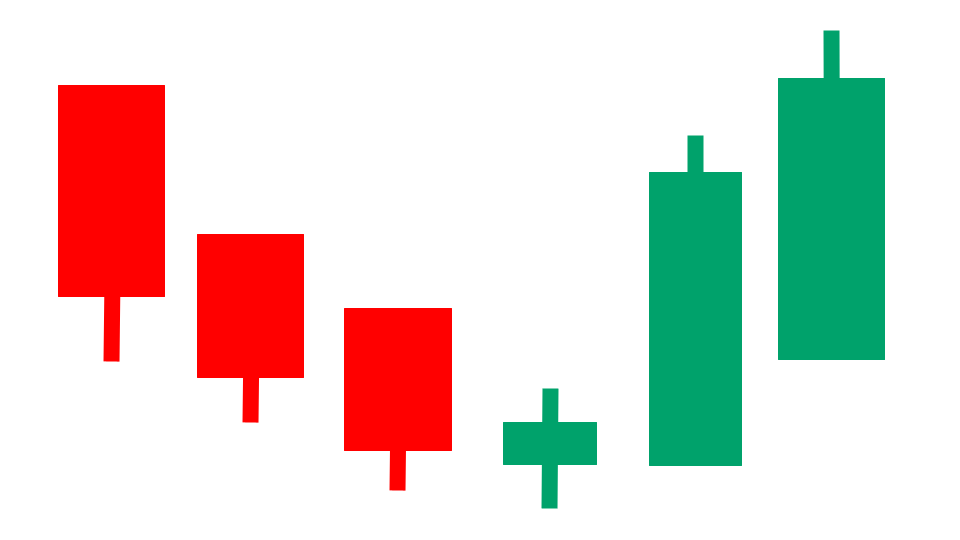

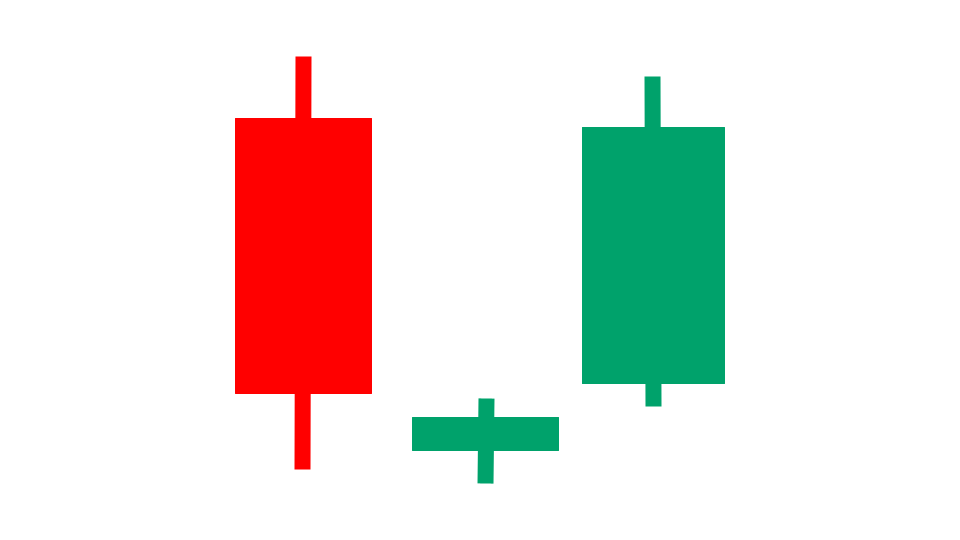

SunOpta Inc. In Our Stock Scanner

As of Aug 19, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.