Renaissancere Holdings Ltd

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Renaissancere Holdings Ltd Company Information, Fundamentals, and Technical Indicators

RenaissanceRe Holdings Ltd., together with its subsidiaries, provides reinsurance and insurance products in the United States and internationally. The company operates through Property, and Casualty and Specialty segments. The Property segment writes property catastrophe excess of loss reinsurance contracts to insure insurance and reinsurance companies against natural and man-made catastrophes, including hurricanes, earthquakes, typhoons, and tsunamis, as well as winter storms, freezes, floods, fires, windstorms, tornadoes, explosions, and acts of terrorism; and other property class of products, such as proportional reinsurance, property per risk, property reinsurance, binding facilities, and regional U.S. multi-line reinsurance. The Casualty and Specialty segment writes various classes of products, such as directors and officers, medical malpractice, transactional liability, and professional indemnity; automobile and employer's liability, casualty clash, umbrella or excess casualty, workers' compensation, and general liability; financial and mortgage guaranty, political risk, surety, and trade credit; and accident and health, agriculture, aviation, construction, cyber, energy, marine, satellite, and terrorism. It distributes products and services primarily through intermediaries. The company invests in and manages funds. RenaissanceRe Holdings Ltd. was incorporated in 1993 and is headquartered in Pembroke, Bermuda.

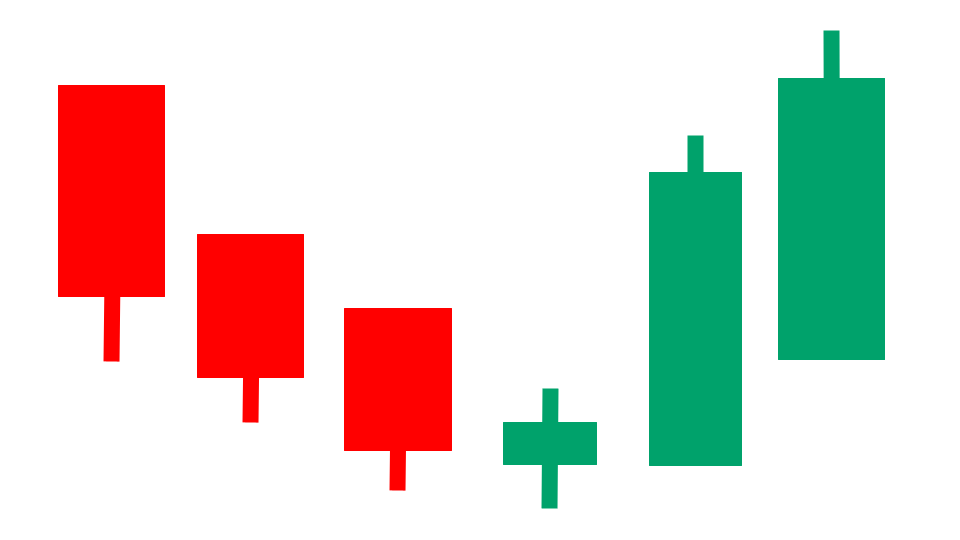

Renaissancere Holdings Ltd In Our Stock Scanner

As of Nov 26, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.