Dun & Bradstreet Holdings Inc.

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Dun & Bradstreet Holdings Inc. Company Information, Fundamentals, and Technical Indicators

Dun & Bradstreet Holdings, Inc. provides business to business data and analytics in North America and internationally. It offers finance and risk solutions, including D&B Finance Analytics, an online application that offers clients real time access to its information, monitoring, and portfolio analysis; D&B Direct, an application programming interface (API) that delivers risk and financial data directly into enterprise applications for real-time credit decision making; D&B Small Business, a suite of tools that allows SMBs to monitor and build their business credit file; D&B Enterprise Risk Assessment Manager, a solution for managing and automating credit decisioning and reporting; and D&B Risk Analytics, an online application that offers clients access to complete and up-to-date global information, monitoring, and portfolio analysis tool to mitigate supply chain, regulatory, and ESG assessment and related risk; Risk Guardian, a subscription-based online and API application that offers clients access to Northern Europe information, monitoring, and portfolio analysis; and D&B Beneficial Ownership that offers risk intelligence on ultimate beneficial ownership. The company also provides sales and marketing solutions, such as D&B Connect, an approach to master data management that allows customers to identify opportunities and potential risks within a business; D&B Optimizer, an integrated data management solution; D&B Direct, an API-enabled data management solution; D&B Rev.Up ABX, an open and agnostic platform that aligns marketing and sales teams to deliver an optimized and coordinated buying; D&B Audience Targeting, which helps clients to reach the right audiences with the right messages; D&B Visitor Intelligence that turns web visitors into leads; D&B Hoovers, a sales intelligence solution; and InfoTorg, an online SaaS application that provides information services. Dun & Bradstreet Holdings, Inc. was founded in 1841 and is headquartered in Jacksonville, Florida.

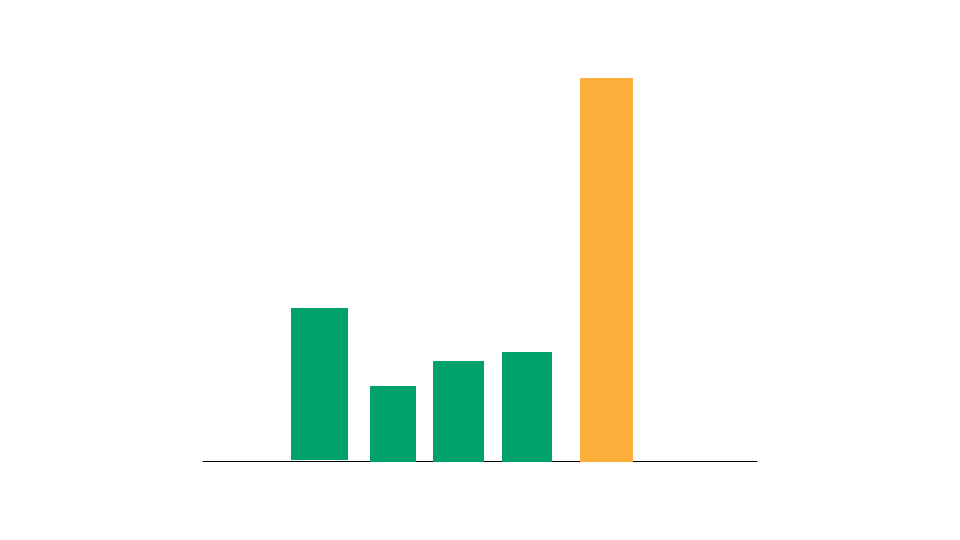

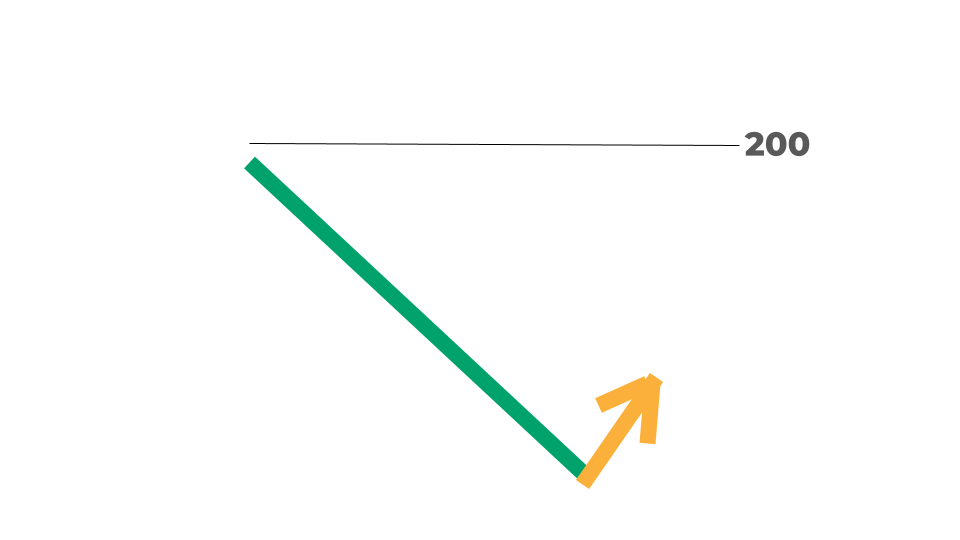

Dun & Bradstreet Holdings Inc. In Our Stock Scanner

As of Aug 05, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.