Extrinsic Value vs Intrinsic Value for Options

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

If you're trying to understand what the difference is between extrinsic value and intrinsic value for options, then you are not alone.

Many people consider options to be one of the most complex investment vehicles available in the stock market, and for good reason since there are many factors that influence their valuations.

Extrinsic Value and Intrinsic Value Are Components of an Option's Value

For any given option that is available in the stock market, it's value is made up of exactly two components: intrinsic value and extrinsic value.

Here is an equation to show their relationship:

This means that intrinsic value and extrinsic value are the core elements of an option's price.

Stock Market Guides

Stock Market Guides identifies option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

150.4%

Intrinsic and Extrinsic Value Definitions

The meaning of intrinsic value is as follows:

The meaning of extrinsic value is as follows:

Extrinsic value can be thought of as a premium you pay to be able to control an option.

Many option buyers look to minimize the extrinsic value of options they buy, while many many option sellers look to maximize the extrinsic value of the options they sell.

This video about intrinsic value vs extrinsic value might help improve your understanding:

Intrinsic and Extrinsic Value Equations

The intrinsic value for call options is calculated as follows:

The intrinsic value for put options is calculated as follows:

The extrinsic value for call options is calculated as follows:

The extrinsic value for put options is calculated as follows:

As an Excel formula, the intrinsic value of a call option would be this:

As an Excel formula, the intrinsic value of a put option would be this:

As an Excel formula, the extrinsic value of a call option would be this:

Extrinsic Value vs Intrinsic Value Example

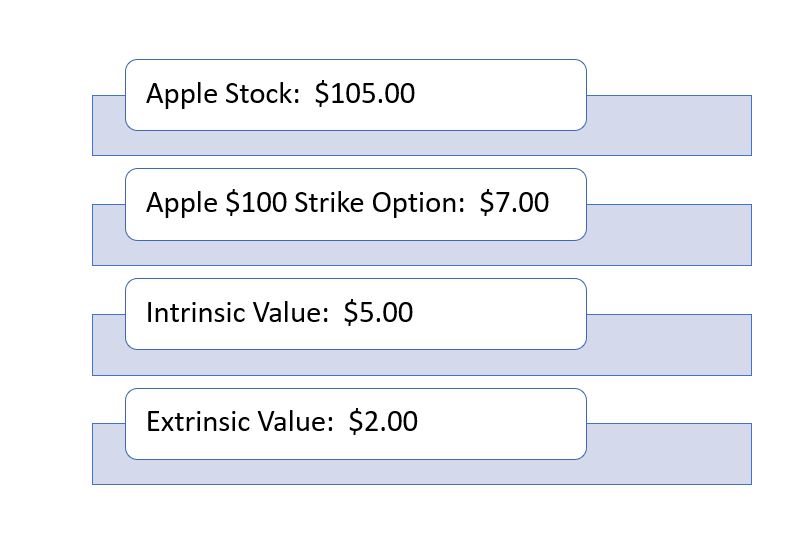

Imagine that you're looking at Apple and considering buying a call option for it.

Imagine Apple stock is selling for $105, and that you are looking at a 100 strike call option for Apple. It doesn't matter which expiration you're considering when it comes to calculating the intrinsic or extrinsic value of an option.

In this case, to get the intrinsic value, we simply take the stock price of $105 and subtract the strike price of $100.

That leaves us with an intrinsic value of $5.

To get the extrinsic value, first we notice that the stock price is higher than the strike price.

Then, as per the equation above, we take the option price ($7) and subtract the difference between the stock price and strike price ($105 - $100 = $5). In other words, we take $7 and subtract $5.

That leaves us with an extrinsic value of $2.

That means if the stock price was $105 at the time of expiration, the value of the option would be $5. At expiration, the only value of the option is its intrinsic value.

That's why the extrinsic value can be thought of as a premium that is paid to have the privilege of controlling an option. By the time the option expires, that value paid for that premium will be gone.

Using that same example, if the strike price of the option were $110, and the price of the option were still $7, then:

-

The intrinsic value would be zero since the strike price is higher than the stock price.

-

The extrinsic value would be $7. Since the strike price is higher than the stock price in that example, the extrinsic value is simply equal to the option's value.

When is Extrinsic Value and Intrinsic Value at Their Highest?

Options that are either at the money or out of the money have values comprised entirely of extrinsic value since they have no intrinsic value. Only options that are in the money have intrinsic value.

That means that the deeper in the money the option is, the more intrinsic value it has.

Typically, the further from expiration the option is, the higher the extrinsic value will be.

Also, in many cases, the further the strike price is from the current stock price, the lower the extrinsic value will be. And by the same token, the closer the strike price is to the current stock price, the higher the extrinsic value will typically be.

Learning More About Intrinsic Value and Extrinsic Value

If you need more help getting up to speed on options and how extrinsic value vs intrinsic value works, take a look at our guide to options trading for beginners.

Our option trading scanner service finds live trade setups that have a backtested edge. You can review the scan results to research option trading opportunities.

If you'd rather leave it to the pros but still want good option investment ideas, you can consider signing up for our options alert service.

You can contact us any time if you would like to ask any questions about extrinsic value, intrinsic value, or about options in general.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.