Brookfield Corp

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Brookfield Corp Company Information, Fundamentals, and Technical Indicators

Brookfield Corporation is a multi-asset manager focused on real estate, credit, renewable power and transition, infrastructure, venture capital, and private equity including growth capital and emerging growth investments. It manages a range of public and private investment products and services for institutional and retail clients. It typically makes investments in sizeable, premier assets across geographies and asset classes. It invests both its own capital as well as capital from other investors. Within private equity and venture capital, it focuses on acquisitions, early ventures, control buyouts, financially distressed buyouts, corporate carve-outs, recapitalizations, convertible, senior and mezzanine financings, operational and capital structure restructuring, strategic re-direction, turnarounds, and underperforming midmarket companies. It invests in both public debt and equity markets. It invests in private equity sectors with focus on business services including infrastructure, healthcare, road fuel distribution and marketing, and real estate; industrials including manufacturers of automotive batteries, graphite electrodes, smart cards, returnable plastic packaging, consumable products for lab testing, and sanitation management and development; and residential/infrastructure services. The firm provides essential business services including business process outsourcing, financial services, software and technology services, and real estate"related services, among others. The firm also invests in energy transition. It targets companies that likely possess underlying real assets, primarily in sectors such as industrial products, building materials, metals, mining, homebuilding, oil and gas, paper and packaging, manufacturing, and forest products. It invests globally with focus on North America including Brazil, the United States, and Canada; Europe; Australia; the Middle East and North Africa; and Asia-Pacific. The firm considers equity investments in the range of $2 million to $500 million. It has a four-year

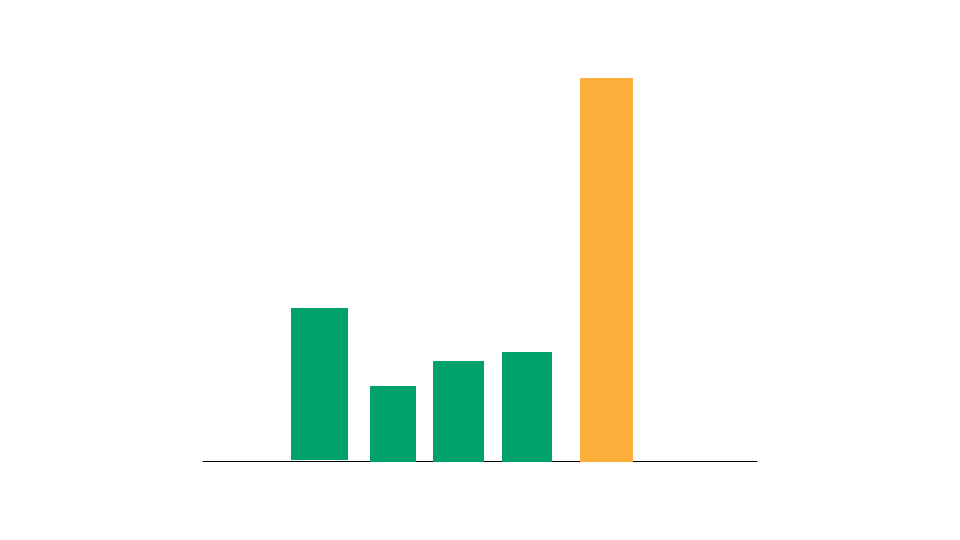

Brookfield Corp In Our Stock Scanner

As of Mar 02, 2026

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.