ZTO Express (Cayman) Inc

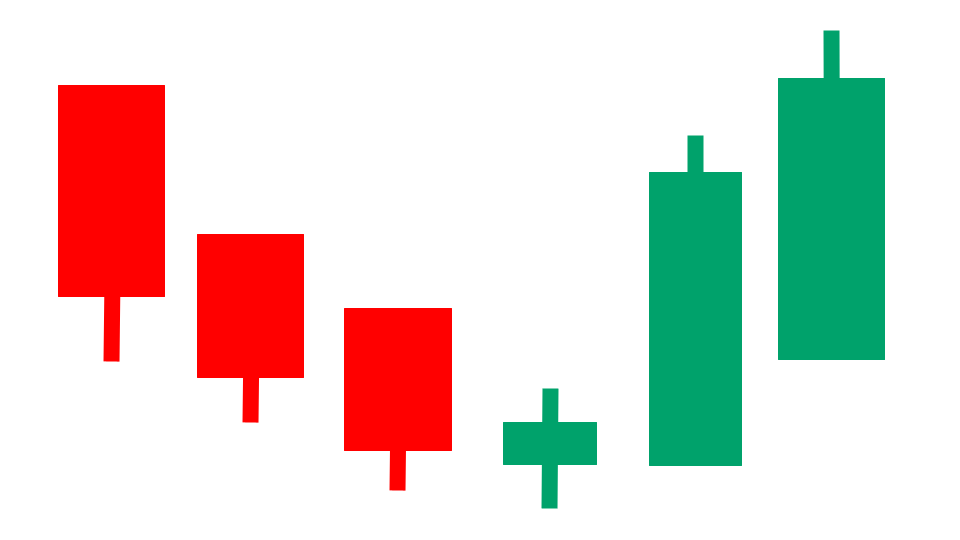

Stock Chart, Company Information, and Scan Results

$19.09(as of Oct 9, 3:59 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

ZTO Express (Cayman) Inc Company Information, Fundamentals, and Technical Indicators

Stock Price$19.09

Ticker SymbolZTO

ExchangeNyse

SectorIndustrials

IndustryIntegrated Freight & Logistics

Employees23,913

CountyUSA

Market Cap$14,896.3M

EBIDTA14,392.2M

P/E Ratio1.82

Forward P/E Ratio11.59

Earnings per Share1.49

Profit Margin16.38%

RSI53.37

Shares Outstanding591.3M

ATR0.43

52-Week High25.15

Volume2,941,618

52-Week Low15.77

Book Value64,855.8M

P/B Ratio0.24

Upper Keltner19.85

P/S Ratio0.34

Lower Keltner17.94

Debt-to-Equity Ratio19.85

Next Earnings Date11/25/2025

Cash Surplus-15,163.0M

Next Ex-Dividend DateUnknown

ZTO Express (Cayman) Inc. provides express delivery and other value-added logistics services in the People's Republic of China. It offers freight forwarding services; and delivery services for e-commerce merchants and traditional merchants, and other express service users. The company was founded in 2002 and is headquartered in Shanghai, the People's Republic of China.

ZTO Express (Cayman) Inc In Our Stock Scanner

As of Oct 10, 2025

Scan Name: Increasing Book ValueScan Type: Stock Fundamentals

As of ---

Scan Name: Unusual VolumeScan Type: Stock Indicator Scans

As of ---

Scan Name: Heikin Ashi BreakoutScan Type: Candlestick Pattern Scans

As of ---

Scan Name: Blue Chip Stocks with Low PE RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Undervalued StocksScan Type: Stock Fundamentals

As of ---

Scan Name: Low PB RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Low PE RatiosScan Type: Stock Fundamentals

As of ---

Scan Name: Low PS RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Low Debt to Equity RatioScan Type: Stock Fundamentals

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.