Sixth Street Specialty Lending Inc

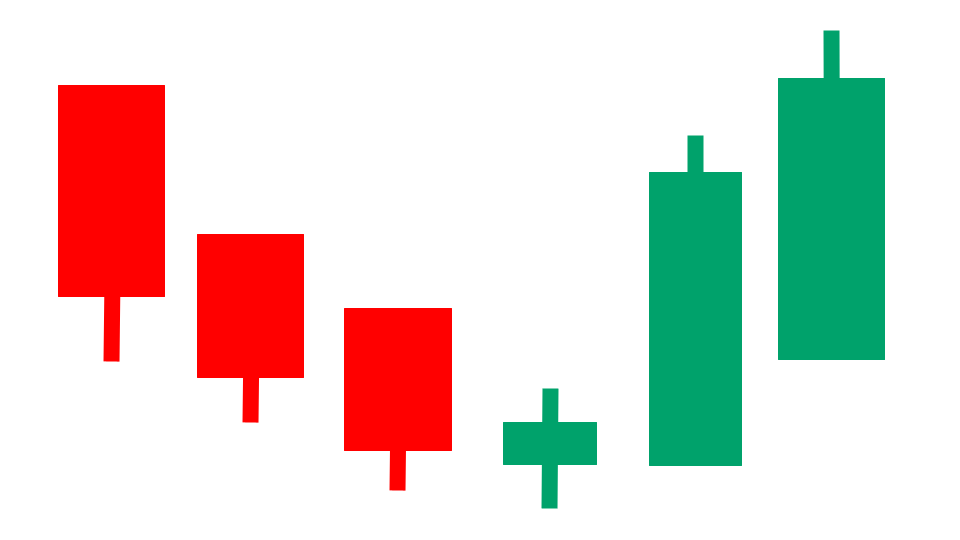

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Sixth Street Specialty Lending Inc Company Information, Fundamentals, and Technical Indicators

Sixth Street Specialty Lending, Inc. (NYSE: TSLX) is a business development company. The fund provides senior secured loans (first-lien, second-lien, and unitranche), unsecured loans, mezzanine debt, and investments in corporate bonds and equity securities and structured products, non-control structured equity, and common equity with a focus on co-investments for organic growth, acquisitions, market or product expansion, restructuring initiatives, recapitalizations, and refinancing. The fund invests in business services, software & technology, healthcare, energy, consumer & retail, manufacturing, industrials, royalty related businesses, education, and specialty finance. The fund seeks to finance and lending to middle market companies principally located in the United States. The fund invests in companies with enterprise value between $50 million and $1 billion or more and EBITDA between $10 million and $250 million. The transaction size is between $15 million and $350 million. The fund invests across the spectrum of the capital structure and can arrange syndicated transactions of up to $500 million and hold sizeable positions within its credits.

Sixth Street Specialty Lending Inc In Our Stock Scanner

As of Aug 07, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.