Rush Street Interactive Inc

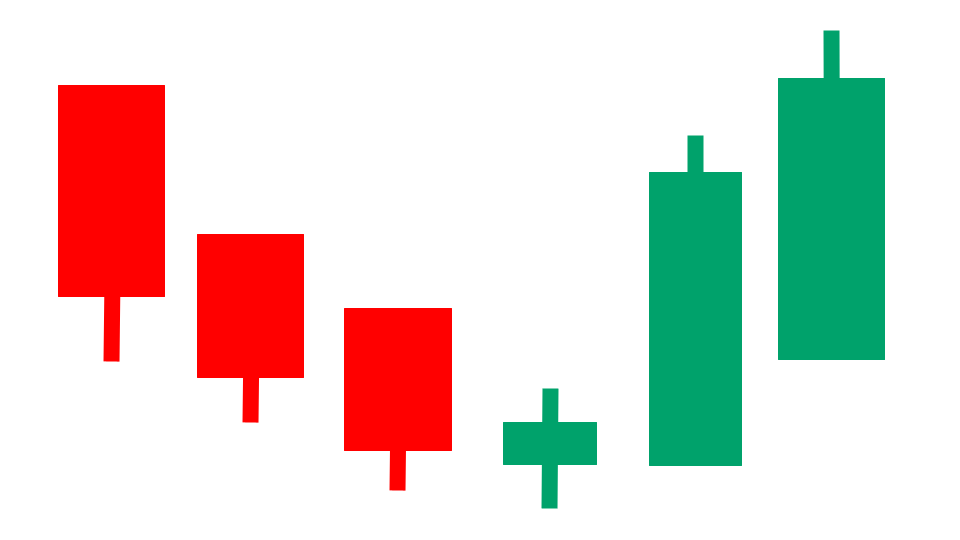

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Rush Street Interactive Inc Company Information, Fundamentals, and Technical Indicators

Rush Street Interactive, Inc. operates as an online casino and sports betting company in the United States, Canada, and Latin America. The company offers real-money online casino, online and retail sports betting, and social gaming services. It also provides full suite of games comprising bricks-and-mortar casinos, such as table games, slot machines, and poker games. The company offers its products under BetRivers, PlaySugarHouse, and RushBet brands. Rush Street Interactive, Inc. was founded in 2012 and is headquartered in Chicago, Illinois.

Rush Street Interactive Inc In Our Stock Scanner

As of Sep 11, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.