BeiGene, Ltd.

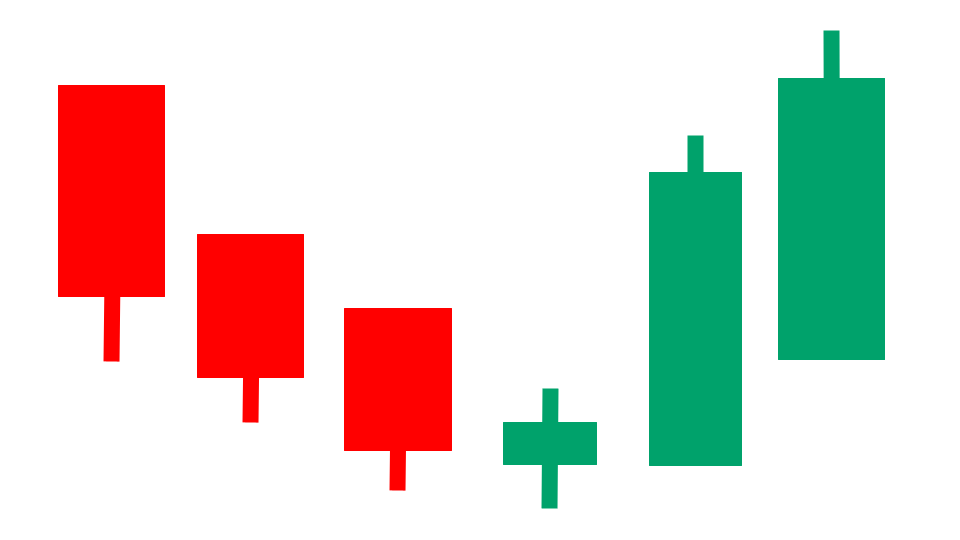

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

BeiGene, Ltd. Company Information, Fundamentals, and Technical Indicators

BeOne Medicines AG, an oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally. The company's commercial stage products include BRUKINSA, a small molecule inhibitor of Bruton's Tyrosine Kinase (BTK) for the treatment of various blood cancers; TEVIMBRA, an anti-PD-1 antibody immunotherapy for the treatment of various solid tumor and blood cancers; and PARTRUVIX, a selective small molecule inhibitor of PARP1 and PARP2 enzymes that is being evaluated as a monotherapy and in combinations for the treatment of various solid tumors. Its clinical stage products comprise Sonrotoclax BGB-11417, a small molecule Bcl-2 inhibitor; BGB-16673, a BTK-targeting chimeric degradation activation compound active against wild-type and mutant BTK; Ociperlimab (BGB-A1217), a TIGIT inhibitor; BG-60366, an EGFR-targeted CDAC; BG-89894 (SYH2039), a MAT2A Inhibitor; BGB-58067, an MTA-Cooperative PRMT5 Inhibitor; BG-T187, an anti-EGFRxMET trispecific antibody; BGB-26808, a HPK-1 Inhibitor; BGB-C354, an anti-B7H3 ADC; Zanidatamab, a bispecific HER2-targeted antibody; BG-C137, an anti-FGFR2b ADC; BGB-53038, a Pan-KRAS Inhibitor; BGB-B2033, an anti-GPC3x4-1BB bispecific antibody; BGB-B3227, an anti-MUC1xCD16A bispecific antibody; BG-C477, an anti-CEAADC; BGB-43395, a CDK4 Inhibitor; BG-68501, a CDK2 Inhibitor; BG-C9074, an anti-B7H4 ADC; BGB-21447, a Bcl-2 Inhibitor; and BGB-45035, an IRAK4-targeted CDAC. It also has various preclinical programs. The company has agreements Amgen, BMS, Bio-Thera, EUSA Pharma, Luye Pharmaceutical, and Novartis. The company was formerly known as BeiGene, Ltd. and changed its name to BeOne Medicines AG in May 2025. BeOne Medicines AG was founded in 2010 and is based in Basel, Switzerland.

BeiGene, Ltd. In Our Stock Scanner

As of Nov 03, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.