Mister Car Wash, Inc. Common Stock

Stock Chart, Company Information, and Scan Results

$5.33(as of Oct 1, 3:59 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Mister Car Wash, Inc. Common Stock Company Information, Fundamentals, and Technical Indicators

Stock Price$5.33

Ticker SymbolMCW

ExchangeNyse

SectorConsumer Cyclical

IndustryAuto & Truck Dealerships

Employees6,640

CountyUSA

Market Cap$1,754.2M

EBIDTA284.5M

P/E Ratio20.26

Forward P/E Ratio10.20

Earnings per Share0.26

Profit Margin10.77%

RSI38.54

Shares Outstanding327.3M

ATR0.15

52-Week High8.60

Volume1,241,222

52-Week Low5.23

Book Value1,071.0M

P/B Ratio1.65

Upper Keltner5.75

P/S Ratio1.72

Lower Keltner5.09

Next Earnings Date11/06/2025

Cash Surplus-150.0M

Next Ex-Dividend DateUnknown

Mister Car Wash, Inc., together with its subsidiaries, provides conveyorized car wash services in the United States. It offers express exterior and interior cleaning services. The company serves individual retail and corporate customers. The company was formerly known as Hotshine Holdings, Inc. and changed its name to Mister Car Wash, Inc. in March 2021. Mister Car Wash, Inc. was founded in 1996 and is headquartered in Tucson, Arizona.

Mister Car Wash, Inc. Common Stock In Our Stock Scanner

As of Oct 02, 2025

Scan Name: Increasing Book ValueScan Type: Stock Fundamentals

As of ---

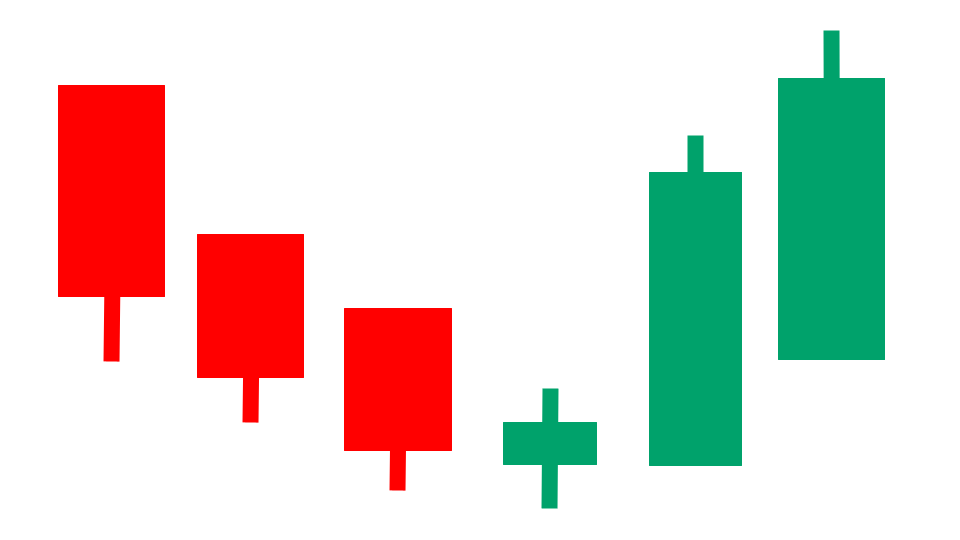

Scan Name: Heikin Ashi BreakoutScan Type: Candlestick Pattern Scans

As of ---

Scan Name: Falling WedgeScan Type: Chart Pattern Scans

As of ---

Scan Name: Increasing Profit MarginScan Type: Stock Fundamentals

As of ---

Scan Name: Low PS RatioScan Type: Stock Fundamentals

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.