Louisiana-Pacific Corporation

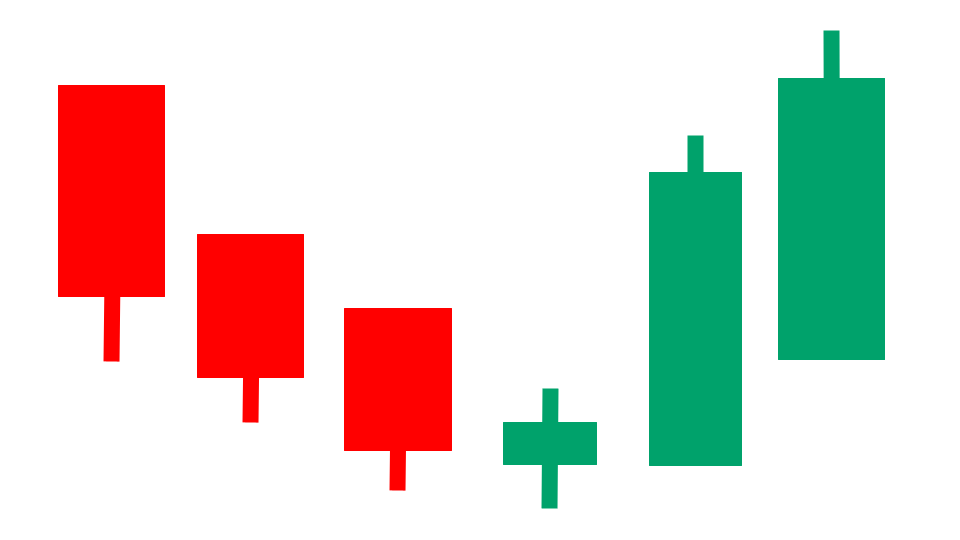

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Louisiana-Pacific Corporation Company Information, Fundamentals, and Technical Indicators

Louisiana-Pacific Corporation, together with its subsidiaries, provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets. It operates through three segments: Siding, Oriented Strand Board (OSB), and LP South America (LPSA). The Siding segment consists of a portfolio of engineered wood siding, trim, soffit, and fascia products, including LP SmartSide trim and siding, LP SmartSide ExpertFinish trim and siding, LP BuilderSeries lap siding, and LP outdoor building solutions. The OSB segment manufactures and distributes OSB structural panel products, including the value-added OSB product portfolio comprising LP Structural Solutions, which includes LP TechShield radiant barriers, LP WeatherLogic air and water barriers, LP Legacy premium sub-floorings, LP NovaCore thermal insulated sheathing, LP FlameBlock fire-rated sheathing, and LP TopNotch 350 durable sub-flooring. The LPSA segment manufactures and distributes OSB structural panel and siding solutions. This segment distributes and sells a variety of companion products for the region's transition to wood frame construction. The company sells its products primarily to retailers, wholesalers, home building, and industrial businesses in North America, South America, Asia, Australia, and Europe. Louisiana-Pacific Corporation was incorporated in 1972 and is headquartered in Nashville, Tennessee.

Louisiana-Pacific Corporation In Our Stock Scanner

As of Sep 05, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.