Grab Holdings Ltd

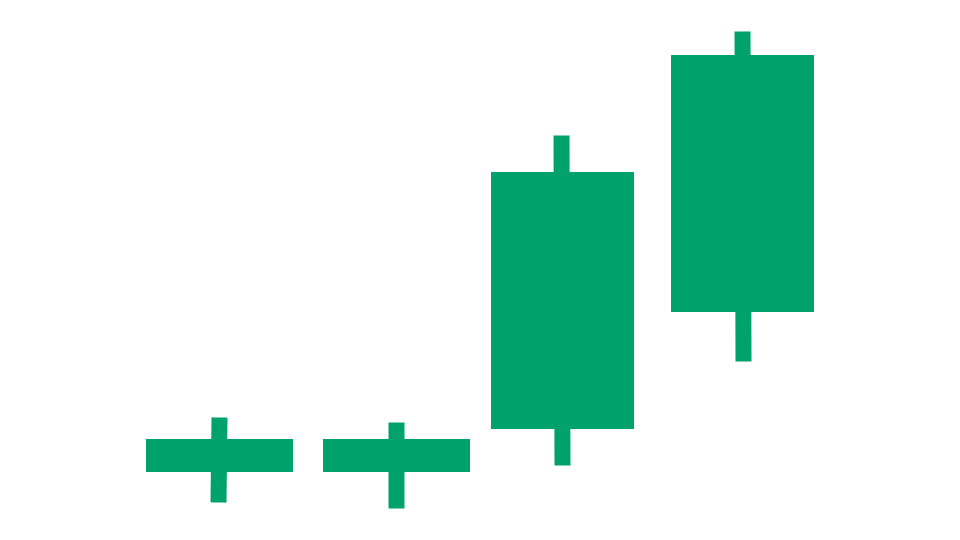

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Grab Holdings Ltd Company Information, Fundamentals, and Technical Indicators

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. It operates through four segments: Deliveries, Mobility, Financial services, and Others. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, and digital financial services. It also provides digital banking services. Grab Holdings Limited was founded in 2012 and is headquartered in Singapore.

Grab Holdings Ltd In Our Stock Scanner

As of Sep 15, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.