Salesforce.com Inc

Stock Chart, Company Information, and Scan Results

$196.05(as of Mar 3, 4:00 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Salesforce.com Inc Company Information, Fundamentals, and Technical Indicators

Stock Price$196.05

Ticker SymbolCRM

ExchangeNyse

SectorTechnology

IndustrySoftware - Application

Employees76,453

CountyUSA

Market Cap$183,688.4M

EBIDTA12,548.0M

10-Day Moving Average189.68

P/E Ratio24.71

20-Day Moving Average190.29

Forward P/E Ratio14.71

50-Day Moving Average223.22

Earnings per Share7.49

200-Day Moving Average245.67

Profit Margin17.35%

RSI45.87

Shares Outstanding937.0M

ATR8.74

52-Week High296.15

Volume13,122,819

52-Week Low174.57

Book Value59,142.0M

P/B Ratio3.12

Upper Keltner209.97

P/S Ratio4.44

Lower Keltner170.62

Debt-to-Equity Ratio209.97

Next Earnings Date05/27/2026

Cash Surplus-29,791.0M

Next Ex-Dividend Date04/09/2026

CRM is on a mission to supercharge sales teams all over the world with its powerful SaaS Customer Relationship Management platform. Its innovative and intuitive platform allows organizations to manage their customer iteration and sales processes effectively. The cloud-based software is used by over 150,000 customers making it the #1 CRM platform in the world.

Salesforce.com Inc In Our Stock Scanner

As of Mar 04, 2026

Scan Name: Low Debt to Equity RatioScan Type: Stock Fundamentals

As of ---

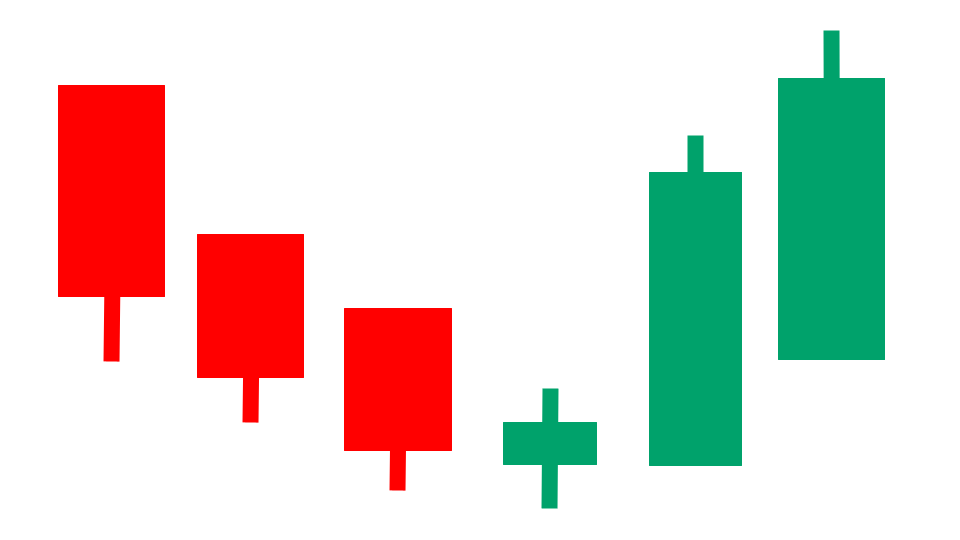

Scan Name: Heikin Ashi BreakoutScan Type: Candlestick Pattern Scans

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.