Circle Internet Group, Inc.

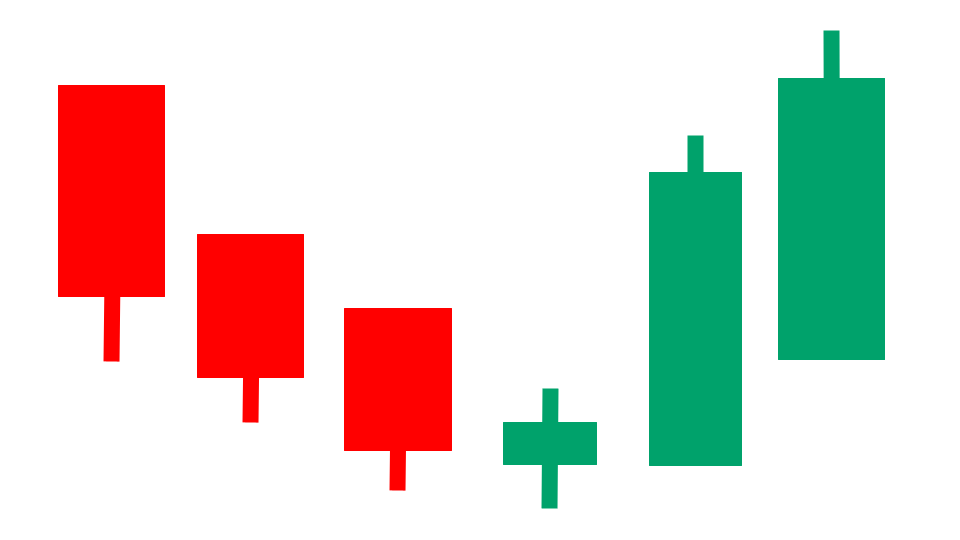

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Circle Internet Group, Inc. Company Information, Fundamentals, and Technical Indicators

Circle Internet Group, Inc. operates as a platform, network, and market infrastructure for stablecoin and blockchain applications. The company provides a suite of stablecoins and related products that include a network utility and application platform for organizations to benefit from stablecoins and the internet financial system; and issues a U.S. dollar-denominated stablecoin. Its stablecoins network comprises circle stablecoins, tokenized funds, liquidity, payments, and developer services, as well as integration services. The company was founded in 2013 and is based in New York, New York.

Circle Internet Group, Inc. In Our Stock Scanner

As of Nov 03, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.