Bellring Brands LLC

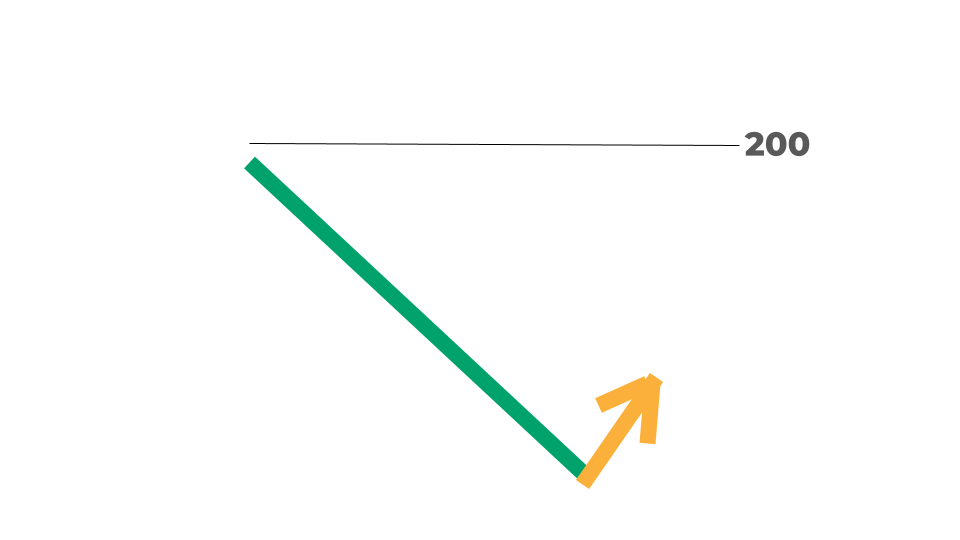

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Bellring Brands LLC Company Information, Fundamentals, and Technical Indicators

BellRing Brands, Inc., together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, protein powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels. BellRing Brands, Inc. was incorporated in 2019 and is headquartered in Saint Louis, Missouri.

Bellring Brands LLC In Our Stock Scanner

As of Oct 30, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.