Bilibili Inc

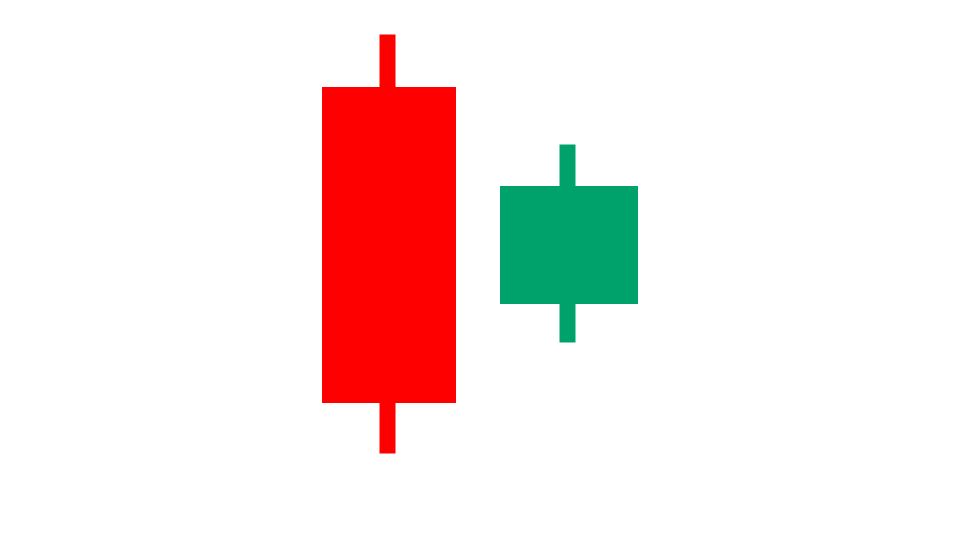

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Bilibili Inc Company Information, Fundamentals, and Technical Indicators

Bilibili Inc. provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic. The company also provides advertising services; and IP derivatives and other services. In addition, it engages in the business and technology development activities; e-commerce business; and video, comics, and game distribution activities. Bilibili Inc. was founded in 2009 and is headquartered in Shanghai, the People's Republic of China.

Bilibili Inc In Our Stock Scanner

As of Feb 06, 2026

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.