Brookfield Asset Management Inc

Stock Chart, Company Information, and Scan Results

$49.73(as of Feb 6, 3:59 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Brookfield Asset Management Inc Company Information, Fundamentals, and Technical Indicators

Stock Price$49.73

Ticker SymbolBAM

ExchangeNyse

SectorFinancial Services

IndustryAsset Management

Employees2,500

CountyUSA

Market Cap$78,536.5M

EBIDTA2,776.0M

P/E Ratio31.01

Forward P/E Ratio25.51

Earnings per Share1.52

Profit Margin57.83%

RSI43.98

Shares Outstanding1,612.4M

ATR1.63

52-Week High63.10

Volume4,187,445

52-Week Low40.81

Book Value10,674.0M

P/B Ratio7.57

Upper Keltner54.79

P/S Ratio18.06

Lower Keltner47.48

Debt-to-Equity Ratio54.79

Next Earnings DateUnknown

Cash Surplus-1,921.0M

Next Ex-Dividend Date02/27/2026

Brookfield is yet another alternative asset leader with more than $800 billion in assets under management. This financial titan spreads its risk across renewable power, infrastructure, private equity, real estate, and credit. Investors might find compelling opportunities in leveraging BAM’s highly diversified assets into their portfolios.

Brookfield Asset Management Inc In Our Stock Scanner

As of Feb 06, 2026

Scan Name: Increasing Profit MarginScan Type: Stock Fundamentals

As of ---

Scan Name: Low Debt to Equity RatioScan Type: Stock Fundamentals

As of ---

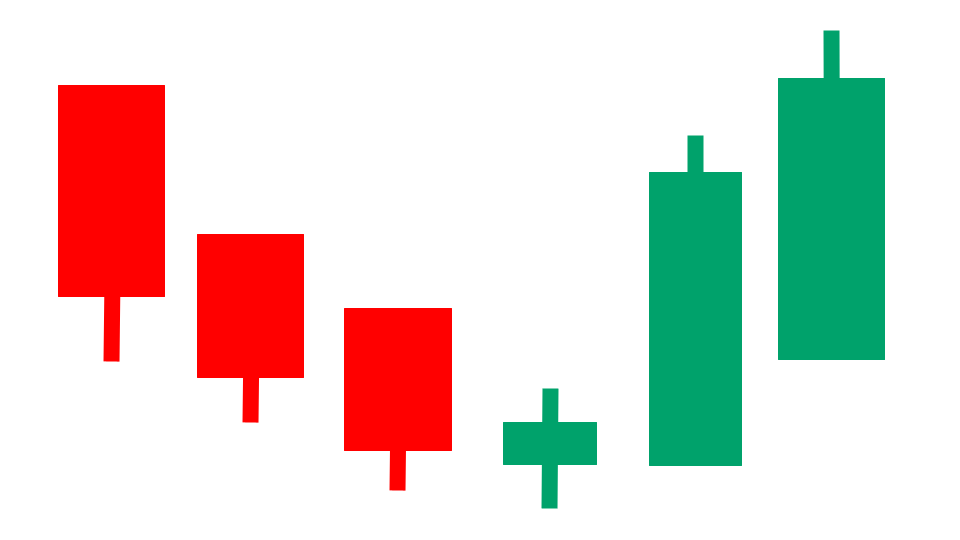

Scan Name: Heikin Ashi BreakoutScan Type: Candlestick Pattern Scans

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.