Alibaba Group Holding Ltd

Stock Chart, Company Information, and Scan Results

$177.18(as of Jan 22, 4:04 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Alibaba Group Holding Ltd Company Information, Fundamentals, and Technical Indicators

Stock Price$177.18

Ticker SymbolBABA

ExchangeNyse

SectorConsumer Cyclical

IndustryInternet Retail

Employees126,661

CountyUSA

Market Cap$387,677.6M

EBIDTA160,290.0M

10-Day Moving Average162.28

P/E Ratio3.28

20-Day Moving Average156.63

Forward P/E Ratio17.79

50-Day Moving Average156.81

Earnings per Share7.50

200-Day Moving Average138.99

Profit Margin8.48%

RSI60.00

Shares Outstanding2,387.3M

ATR5.92

52-Week High192.67

Volume11,577,923

52-Week Low84.29

Book Value1,111,785.0M

P/B Ratio0.36

Upper Keltner169.96

P/S Ratio0.40

Lower Keltner143.31

Debt-to-Equity Ratio169.96

Next Earnings Date02/19/2026

Cash Surplus-309,068.0M

Next Ex-Dividend DateUnknown

Alibaba is China’s largest online marketplace and a technology company that diversifies into various market segments. Their eCommerce platform opens the gates of Chinese manufacturing to the world by offering access to numerous vendors around the country. Their competitive prices draw in close to a billion users each year, setting itself as a global leader in eCommerce.

Alibaba Group Holding Ltd In Our Stock Scanner

As of Jan 22, 2026

Scan Name: Low PS RatioScan Type: Stock Fundamentals

As of ---

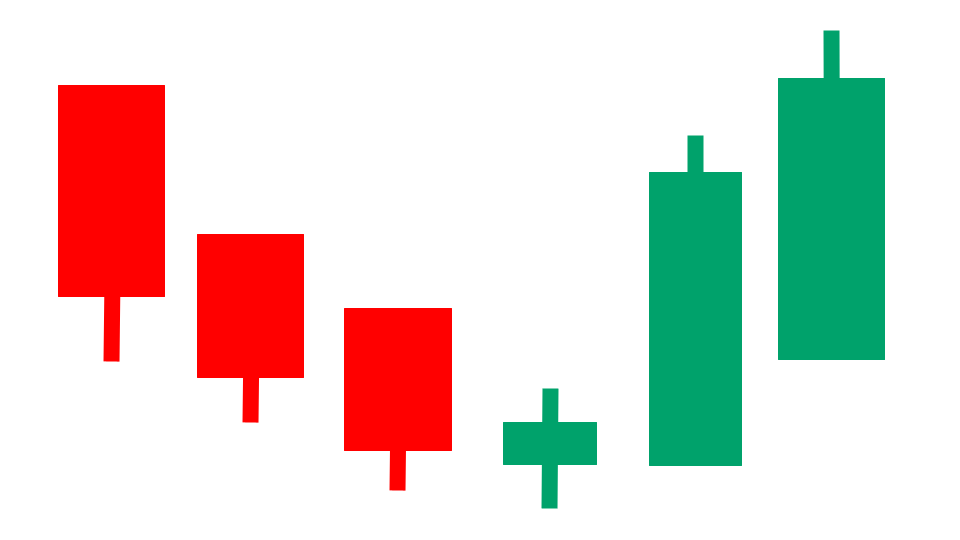

Scan Name: Heikin Ashi BreakoutScan Type: Candlestick Pattern Scans

As of ---

Scan Name: Blue Chip Stocks with Low PE RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Undervalued StocksScan Type: Stock Fundamentals

As of ---

Scan Name: Low PE RatiosScan Type: Stock Fundamentals

As of ---

Scan Name: Low PB RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Low Debt to Equity RatioScan Type: Stock Fundamentals

As of ---

Scan Name: Increasing Book ValueScan Type: Stock Fundamentals

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.