Antero Resources Corp

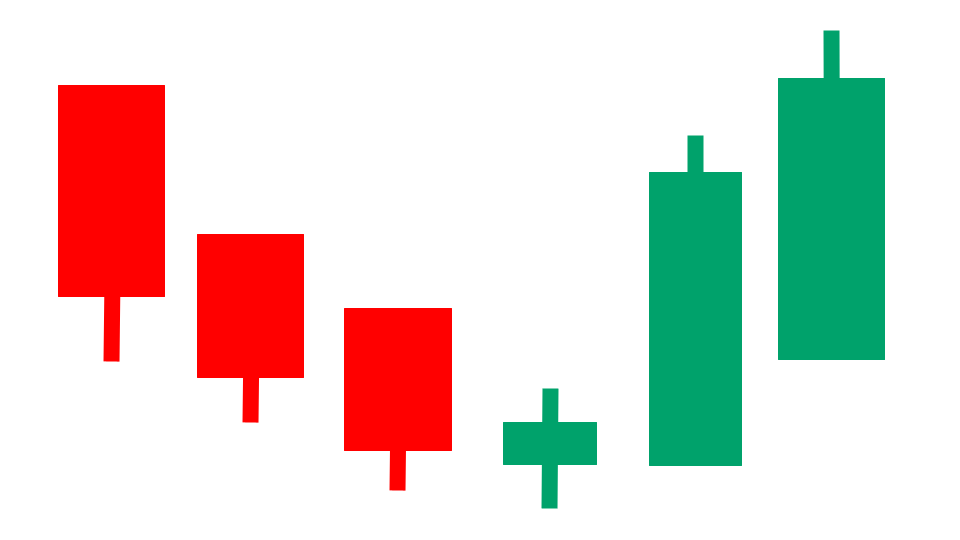

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Antero Resources Corp Company Information, Fundamentals, and Technical Indicators

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Production; Marketing; and Equity Method Investment in Antero Midstream. As of December 31, 2024, the company had approximately 521,000 net acres in the Appalachian Basin; and approximately 170,000 net acres in the Upper Devonian Shale. Its gathering and compression systems also comprise 708 miles of gas gathering pipelines in the Appalachian Basin. The company was formerly known as Antero Resources Appalachian Corporation and changed its name to Antero Resources Corporation in June 2013. Antero Resources Corporation was incorporated in 2002 and is headquartered in Denver, Colorado.

Antero Resources Corp In Our Stock Scanner

As of Aug 18, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.