Advanced Micro Devices Inc

Stock Chart, Company Information, and Scan Results

$196.36(as of Mar 5, 1:17 PM EST)

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Advanced Micro Devices Inc Company Information, Fundamentals, and Technical Indicators

Stock Price$196.36

Ticker SymbolAMD

ExchangeNasdaq

SectorTechnology

IndustrySemiconductors

Employees31,000

CountyUSA

Market Cap$311,327.0M

EBIDTA6,745.0M

10-Day Moving Average202.04

P/E Ratio76.87

20-Day Moving Average204.05

Forward P/E Ratio29.67

50-Day Moving Average218.34

Earnings per Share2.62

200-Day Moving Average187.81

Profit Margin14.71%

RSI45.19

Shares Outstanding1,630.4M

ATR10.95

52-Week High267.08

Volume40,110,276

52-Week Low76.48

Book Value62,999.0M

P/B Ratio5.29

Upper Keltner228.70

P/S Ratio9.62

Lower Keltner179.41

Debt-to-Equity Ratio228.70

Next Earnings Date05/05/2026

Cash Surplus-3,916.0M

Next Ex-Dividend DateUnknown

If AMD were a superhero its superpower would be computer processing. Its graphics cards and processors are used in some of the world's most advanced computers, including gaming rigs and data centers. But AMD’s technology is not the only superpower behind semiconductor stock. Shares of the company delivered close to 9000% in returns to investors between 2015 and 2021—not bad at all.

Advanced Micro Devices Inc In Our Stock Scanner

As of Mar 05, 2026

Scan Name: Increasing Book ValueScan Type: Stock Fundamentals

As of ---

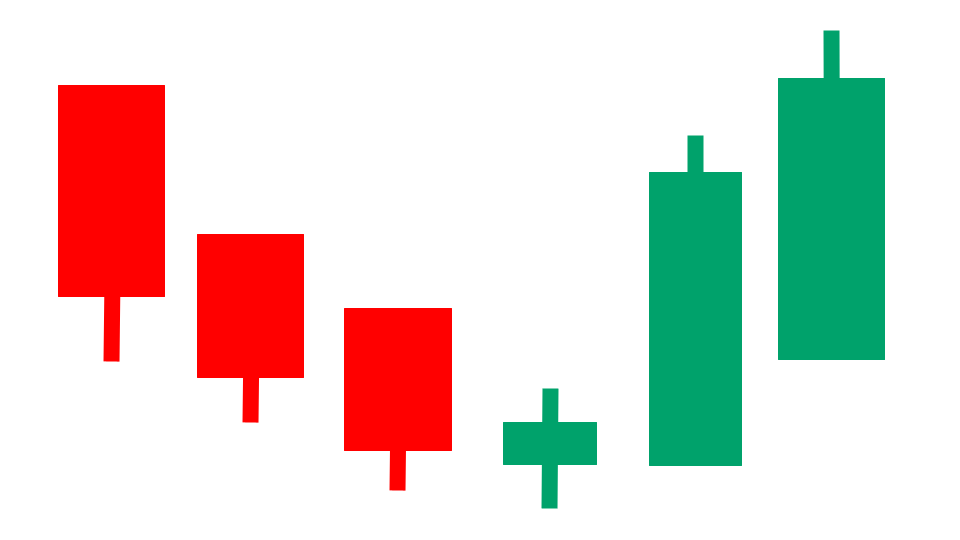

Scan Name: Heikin Ashi BreakoutScan Type: Candlestick Pattern Scans

As of ---

Scan Name: Discounted Stocks with Earnings GrowthScan Type: Stock Fundamentals

As of ---

Scan Name: Undervalued StocksScan Type: Stock Fundamentals

As of ---

Scan Name: Increasing Profit MarginScan Type: Stock Fundamentals

As of ---

Scan Name: Low Debt to Equity RatioScan Type: Stock Fundamentals

As of ---

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.