Alaska Air Group Inc

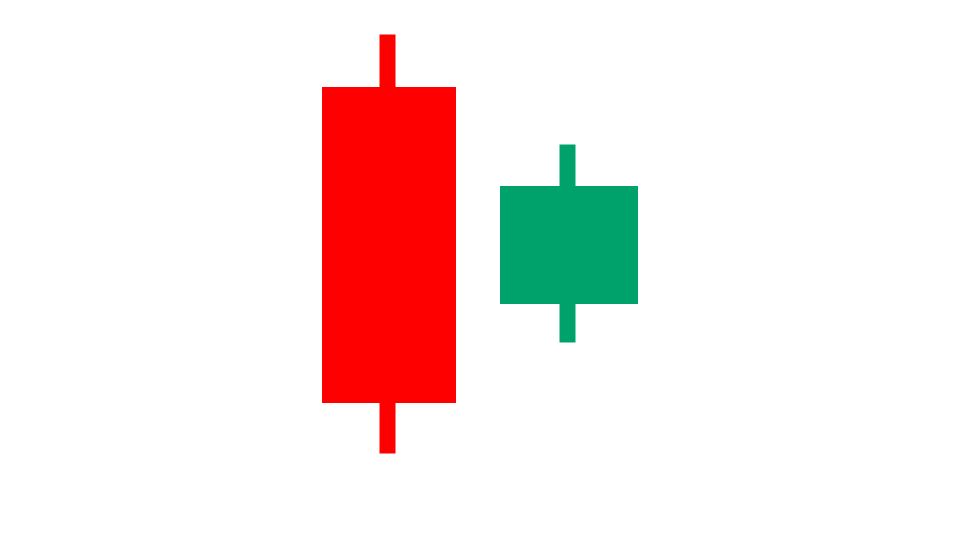

Stock Chart, Company Information, and Scan Results

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Alaska Air Group Inc Company Information, Fundamentals, and Technical Indicators

Alaska Air Group, Inc., through its subsidiaries, operates airlines. It operates through three segments: Alaska Airlines, Hawaiian Airlines, and Regional. The company offers scheduled air transportation services on Boeing jet aircraft for passengers and cargo in the United States, and in parts of Canada, Mexico, Costa Rica, Belize, Guatemala, and the Bahamas; and for passengers across a shorter distance network within the United States, Canada, and Mexico. Alaska Air Group, Inc. was founded in 1932 and is based in Seattle, Washington.

Alaska Air Group Inc In Our Stock Scanner

As of Oct 14, 2025

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.