Gap Down Meaning - With an Example

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Sometimes in a conversation about the stock market, you might hear someone say, "the stock gapped down overnight". If you're not sure what exactly that means, then you're in the right place.

This article will explain what the term gap down means in the context of the stock market.

Gap Down Definition

To understand the meaning of the term "gap down", first you need to understand that the US stock market is not open 24 hours a day. There are periods when it is closed and no one can trade stocks.

During those periods when the stock market is closed, sometimes news or events occur that can affect a stock's price. An example of this when a company reports earnings while the stock market is closed.

This can cause pressure on the stock price such that by the time the stock market opens the next day, it can be trading at a different price than it was trading for at the end of the prior day.

With that in mind, here is the formal definition:

In more simple terms, a gap down is when the price of a stock jumps down overnight.

A gap down can be minor or major.

Stock Market Guides

Stock Market Guides identifies stock trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Gap Down Example

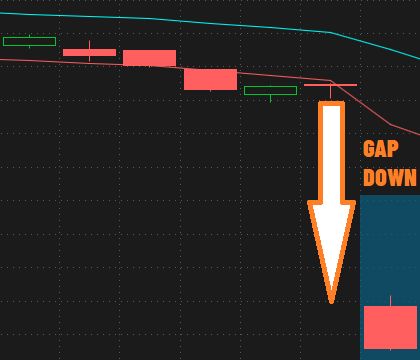

The image above shows a stock chart for Advance Auto Parts (AAP). It's a daily chart which means that each of the price bars represents the price activity for one day during normal open stock market trading hours.

A candle that is green means the price went up during normal trading hours for that day. If it's red, it's the opposite and it means the price went down during normal trading hours.

You can see in the image above that the last price bar reflects an opening price that is well below the closing price of the prior day. That is a gap down.

That one is a particularly large gap down. Not all gap downs are that pronounced.

Video About How a Gap Down Works

This video we made about how gap downs work might be helpful:

Who is Affected by a Gap Down?

Anyone who holds a stock or option position overnight can be affected by a gap down. This is referred to as gap risk.

This means that anyone who has long term investments in the stock market can be affected by a gap down. Also, swing traders can be affected by a gap down.

Day traders often close all their positions before the end of the trading day, which makes them unsusceptible to any overnight price changes.

Does a Gap Down Help You?

If you own a stock that gaps down overnight in price, that means your stock position went down in value overnight, which is unprofitable.

Or if you own a call option where the underlying stock gaps down, it often will have a negative impact on the value of the option.

Sometimes a gap down is relatively minor. These might have a minimal impact on your position's profitability. But occasionally, you get exposed to a really large gap down, and it can be like taking a gut punch.

If you are shorting a stock, then a gap down will make your position more profitable. If you own a put option, it often will have a positive effect on the value of your position.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.