Get Swing Trade Alerts in Real Time by Text or Email

All our trade alerts have a backtested statistical edge.

Swing Trade Service

At Stock Market Guides, we offer a Swing Trading Service that includes trade alerts for our favorite picks. We use historical statistics to help you buy low and sell high in the stock market using swing trades. Our service only features swing trading opportunities that have a quantitative backtested edge. We don’t shoot from the hip with trade ideas here. We rely exclusively on the data. This ensures that if you get a swing trade alert, it’s because there is a trade opportunity that has a track record of success in backtests.

Swing Trading Alerts

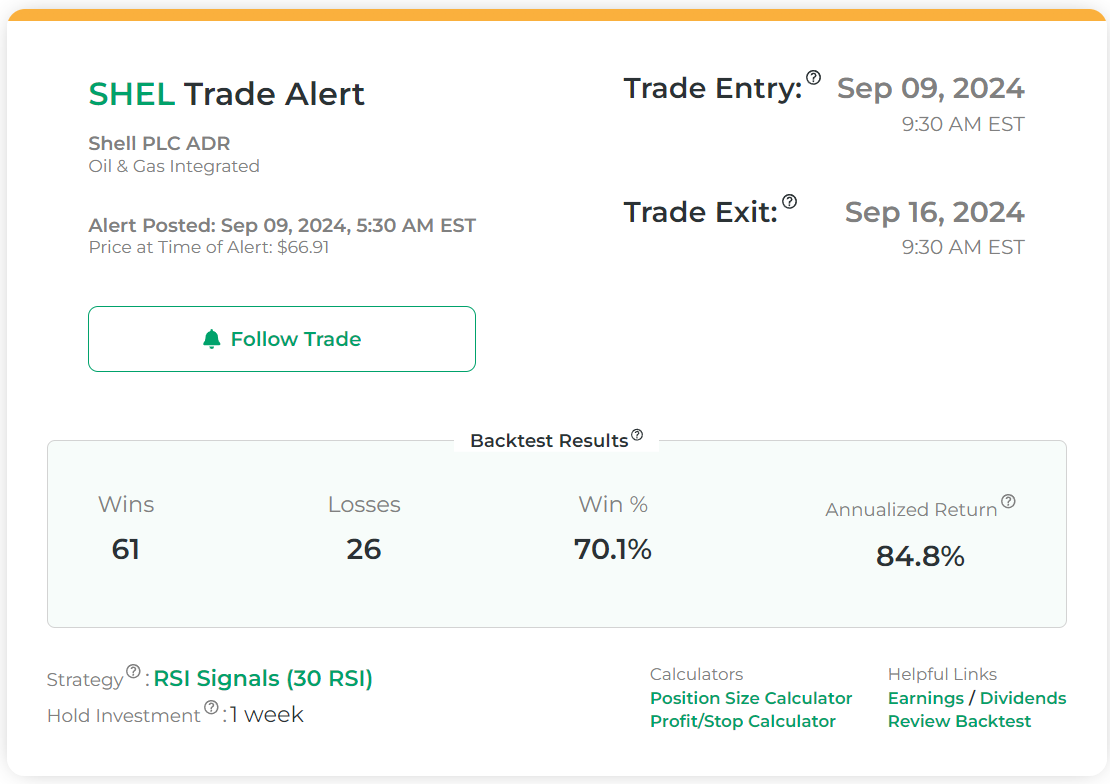

Each swing trade alert indicates the full scope of the trade idea: the ticker symbol, when to buy it, and when to sell it. You can see that our swing trade alerts reflect a specific trading strategy and time frame. They also show how that strategy has performed historically according to backtests, both in terms of wins, losses, and return on investment. We want to offer the best swing trade alerts possible, so they need to be easy to follow, have a track record of success, and be transparent.

Performance of Swing Trade Alerts

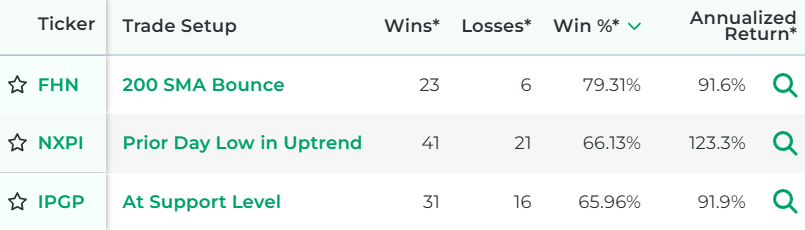

We’re well qualified to do statistical research on historical stock performance. We have years of experience doing stock market research and use a rigorous statistical process for testing each swing trading strategy we feature. Here is the performance of our swing trading picks in backtests:

Swing Trade Picks:

Please note that this performance information is not based on live trades, but on backtests, which have important limitations. Swing trading in the stock market involves risk, even when trade setups have a strong history of profitability. You can dial your risk down or up by adjusting your position sizing or the number of trades you take. The more risk that’s taken, the higher the potential for drawdowns. You can also start out by paper trading stocks to get a feel for the trades before putting real money at risk.

Features of Our Swing Trading Picks

Anyone who signs up for our Swing Trading Service gets access to all these features:

Swing Trading Picks Powered by Our One-of-a-Kind Scanner

Our proprietary swing trading scanner is the power plant behind each of our stock alerts. It's the technology that identifies trading opportunities in real time and calculates their historical performance. Our scanner uses this information to isolate the swing trades that have the very best historical track record of success, and it sends those out as stock picks to our customers each week.

For Active Stock Traders

Up to:

Swing Trade Alerts per Week

Our swing trade picks are designed for people who are looking to hold positions for 1 week to 1 month. These picks are for active stock traders. We send out up to ten stock picks per week with our swing trading service. Some weeks there might be less. It depends on market conditions, and our scanner will never send stock picks unless it sees an opportunity with a strong backtested edge. If you're looking for less active stock trading than that, you can consider our buy-and-hold stock picking service, where trades often last three months to a year. For options, you could check out our option trade alerts service, which is based on swing trading strategies.

Support from Swing Trading Experts

We have swing trading experts who offer commentary on a regular basis regarding both our trade alerts and the general state of the market. Their commentary gets sent out to the group in an email newsletter. These experts are readily available for any questions you might have along the way.

Preferred Trade Durations:

Eric is a Senior Consultant for Stock Market Guides and has years of experience doing both stock market research and active trading. He’s a Stanford graduate with a knack for numbers. Statistical research is one of his specialties. He’s backtested thousands of trading strategies in an effort to find out which ones truly perform the best. One of his standout trading achievements is growing his trading account more than 60% in a single month from doing option trades. He also once had a month where his win-loss record with stock trades was 32 wins and 3 losses. He enjoys practicing mindfulness to stay grounded when trading. He has a family with three kids.

Preferred Trade Durations:

Andy has been doing stock market research for several years. He creates algorithms that look for tendencies in the ways that prices move in the market. His research helped him gain a deep understanding of the types of trading strategies that have typically done well over the long haul. Andy is a math whiz who loves working with numbers. He has a wife and two kids.

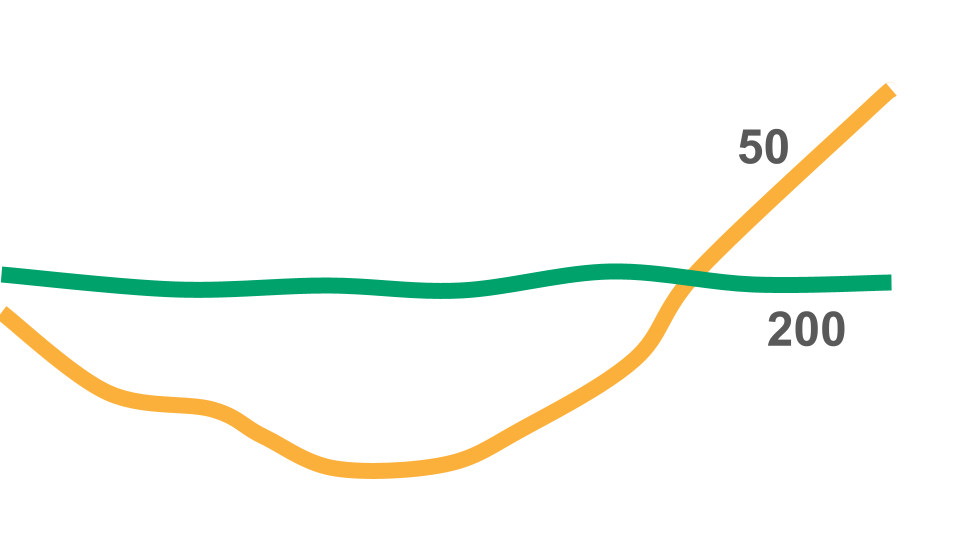

Stock Picks Based on Technical Analysis

For our swing trade alerts, our picks are based primarily on technical analysis. This means that our trade ideas are based on these types of criteria:

If you're looking for stock picks based instead on fundamental analysis, like revenues and earnings, you can consider our service for long term stock picks instead. All of the trading strategies we use for our swing trade alerts are algorithmic.

Swing Trade Alerts That Are Easy to Follow

We send trade alert notifications when we make swing trade picks. They are sent in real time by either text or email, depending on your preference. Trade alerts are sent during normal market hours (typically right after the market opens). Our swing trade alerts show you a specific trade idea that indicates exactly when to buy and sell. You can be alerted when the trade ends, too. Rather than spending a lot of time each day in front of a computer screen doing research on which swing trades to make, you can get these trade alerts and spend just minutes per day making your trades.

Learn Swing Trading

Swing trading is where you make trades that last more than one day but are not long term holds. It’s in between day trading and long-term investing. If you are swing trading, you might own a given stock or option for a matter of days or weeks, not years.

If you don’t know exactly how to buy and sell in the stock market, you can use our free stock guides or options guides to learn the basics. Once you sign up for the service, you’ll also find tutorials that teach our swing trading strategies in detail so that you can learn to trade them on your own if you want. Our goal is to make sure you will have the tools to be able to successfully follow our swing trade alerts no matter what your trading expertise level is. And if questions come up along the way, you can contact us any time and we’ll be ready to help.

Use Our Scanner for More Swing Trade Ideas

Our Swing Trading Service also includes access to our swing trading scanner. If you want more trade ideas beyond what is provided by our swing trade picks, you can use the scanner to find other swing trade setups in real time that have a backtested edge.

As Seen On

Customer Testimonials

I'm making money, that's what matters. Well worth the $70 per month. I hope to, and plan to, use your service for as long as you'll have me.

James from Alabama

So far for September, I have 10 completed trades. 9 had gains, 1 was a loss.

Lori from Arkansas

I am really enjoying the new service. You do a fantastic job of providing both simplicity and education for those who want to learn more.

Jeff from Tennessee

I recently joined your service and I’m very pleased with the results. Again, thank you for what you do.

Vicki from New Hampshire

Videos About Our Swing Trade Alerts Service

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.